What do I mean when I say "Post-Labor Economics" anyways?

When machines are better, faster, cheaper, and safer: This creates an "economic agency paradox"—a death spiral of deflation and collapsed consumer demand. The solution may be tokenomics.

TLDR:

In a nutshell:

The Post-Labor Economic Challenge

Better, Faster, Cheaper, Safer: As AI and robotics become superior to humans in both cognitive and physical domains, the economic implications are inescapable. Machines will simply outperform humans at virtually every task, making automation the only economically rational choice. This isn’t a choice—it’s mathematical inevitability.

Economic Agency Paradox: This creates a critical paradox. While automation promises unprecedented productive efficiency, it simultaneously threatens to eliminate human labor income. Without wages, where does consumer purchasing power come from? Traditional solutions like UBI provide basic subsistence but fail to address the fundamental need for genuine economic participation.

Investment-Based Future: The solution emerges by transforming everyone from laborers into investors in the automated economy. Through AI-assisted investing and universal asset tokenization, people maintain economic agency by directing resources rather than providing labor. Instead of trying to preserve human jobs in an economy that no longer needs them, we create a new form of economic participation.

Core Principles for Implementation:

Universal Asset Tokenization: Everything of economic value must become investable through standardized digital tokens, from local businesses to automated infrastructure.

AI-Enhanced Market Agency: Every individual needs AI agents that can analyze opportunities and execute investments aligned with their preferences and values.

Decentralized Infrastructure: Build open protocols and blockchain networks that enable secure, transparent, and efficient market operations.

Legal Framework Modernization: Create new frameworks that enable AI-speed transactions while protecting human economic rights.

Radical Market Transparency: Require real-time, machine-readable disclosure of all market-relevant information.

Democratic Access Guarantees: Ensure everyone has the practical ability to participate through education, technology, and initial capital.

Value Capture Protection: Design systems that direct value to legitimate stakeholders rather than extractive intermediaries.

This isn’t just a patch on capitalism—it’s a fundamental reimagining of economic participation for an automated age. Instead of fighting the inevitable replacement of human labor, we embrace it while ensuring everyone benefits through investment returns and meaningful economic agency.

The Article

If machines are about to become better, faster, cheaper, and safer than humans, then it does seem economically inevitable that they will replace humans in those areas where they surpass us. (Btw, I use “machines” to represent all electromechanical constructs, including AI and software, some people think machine just means robot)

I call this “post-labor economics” specifically because other terms, like “post-scarcity” and “hyper-abundance” don’t really fit the bill. Let’s unpack why.

Post-scarcity, by definition, means “after we’ve solved all constrains and there is no longer any scarcity.” But that is actually physically impossible, isn’t it? There’s only so much Malibu real estate, we’ve only got one earth, and there’s only so much room for all of us. Then I read some real economics (Harvey, Sowell, Piketty, Blakely) and learned about price signals and market theory and so on. The simple fact is there will always be constraints, even if they move around. We overcame a scarcity of horses by inventing cars, which moved the economics of transit away from barns and farriers and breeders to Toyota and Ford plants, plus all the inputs required to build cars.

Making cars is infinitely more complex than making horses, but the economic affordances of cars (on-demand, they don’t die, they’re faster, carry heavier loads) mean that it’s worth the extra cost in steel, logistics, and the massive plants required to build them. To make more horses you just need a stud and a mare at the right time of year. I know, I was there when my grandpa bred his horse and they produced Valley Girl, who was, you guessed it, born in the valley.

So, post-scarcity is right out. It just doesn’t work. What about hyper-abundance? I can think of a bunch of resources that are hyper-abundant, meaning they are so abundant that you don’t really need to meter them. Air, sun, gravity, wind. They might not be infinite, but there’s so much of them that no one owns the market and we all just draw from the commons. Even water, in many places, is so hyper-abundant we just let it flow into the ocean. Pretty soon, all digital goods will be hyperabundant. Music, images, video—AI can generate stuff to your hearts content. Even porn, video games, and feature length films are coming soon.

So why not make hyper-abundance the goal? Well, again, you run into constraints. And I don’t mean electricity and data centers and AI chips, those are short-term constraints, and once humanity’s latent demand for 24/7 always-unique hyper-personalized porn is satisfied, well, there’s only so much you need to generate. No, let’s look at houses. Houses are still the greatest expense most people have. Will AI make houses much cheaper? Probably not. Robots might, particularly if robots can work round the clock to build houses faster, better, cheaper, and safer than humans could. But labor inputs are between 30% and 50% of building a house, so if you can reduce that dramatically, then sure. But that doesn’t mean that houses will suddenly become hyper-abundant. Hyper-abundance only occurs when it’s too cheap to meter, as Sam Altman so eloquently put it.

You’ll still run into constraints like physics and biology. Lumber is heavy and takes a while to grow. Windows and electrical wiring still require manufacture and transit. Logistics, entropy, all of these things will not just vanish overnight.

Okay, so neither hyper-abundance nor post-scarcity really fit the bill of what’s coming. Puzzled, I sat there thinking “Okay, how can we characterize the Fourth Industrial Revolution? What is it really revolutionizing?”

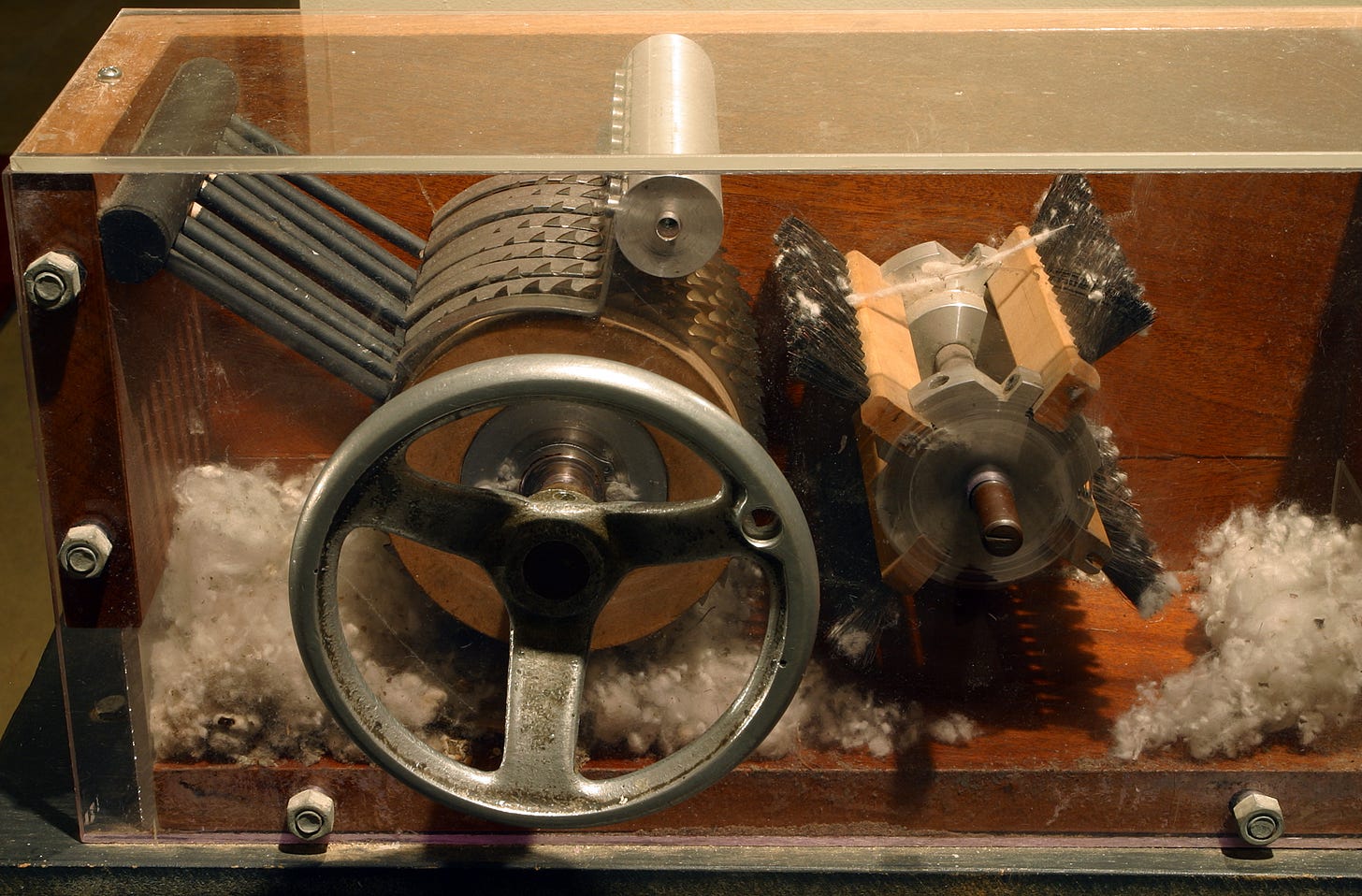

So I looked to history for clues. The First Industrial Revolution was basically the mass introduction of mechanical engineering. We didn’t have super good power sources, but innovations in machining made basic machines more widely accessible. I went on tour here in North Carolina many years ago to an old plantation (aka a school field trip) and I actually saw a big mechanical device that portioned tobacco into little baggies and even tied the knots. Impressive for something almost 200 years old. I even got to use a real cotton gin.

Did this first industrial revolution make anything hyperabundant? No, but it had broad impacts across all of society. Early mechanization dramatically improved efficiency in agriculture and created entirely new kinds of jobs, plus it started the march towards industrialization and mechanization.

Broad efficiency gains

Builders of the machines

Now, that’s not to poo-poo on simple efficiency gains. In some cases, such as with the cotton gin, it made one person more than 300% more efficient at processing cotton, plus it simplified the job from manually picking out seeds to the mind-numbing process of feeding cotton into the machine and turning a crank. Even a small child can do that. Even so, the slow proliferation of new machines created new affordances in society, new job categories, but didn’t really destroy any jobs just yet, at least not en masse.

Things get darker moving forward, with the Second Industrial Revolution being, perhaps, the most destructive revolution, not just socially but just in terms of human costs.

Smog in London became choking, children got dismembered in factories, and the fortunes of entire nations shifted away from agriculture and to industrialization. Furthermore, several enormous wars were fought using these new technologies. Yes, WWI and WWII and two were enabled by the Second Industrial Revolution.

The total cost to humanity was enormous. Dislocated families, world wars, pollution, and the shattering of many ways of life. Yet, we’ll never go back. This is what gave me some pause when researching the Fourth Industrial Revolution: what if it’s so economically disruptive that it harms entire generations—or several generations—of humans due to exploitation, deteriorating conditions, and new ways to wage war?

The rise of drones in Ukraine demonstrates a terrifying new possibility for adversaries to remotely murder countless civilians.

First Industrial Revolution = Steampunk

Second Industrial Revolution = Dieselpunk

Third Industrial Revolution = Cyberpunk

Okay, this is looking grim, isn’t it?

The Third Industrial Revolution is the “Information Age” or the “Digital Revolution” with the rise of transistors, integrated circuits, and CPUs. If you had to identify a single central material for each revolution, the first would be coal/steam, the second would be steel/petroleum, and the third would be silicon/data.

The Third Industrial Revolution has been both far more and less disruptive in various ways. There’s been no World War (yet) with 3IR tech, though you could argue the Cold War was. The mass migration to cities and the categorical destruction of entire ways of life were the result of the last two industrial revolutions.

The Third Industrial Revolution hasn’t been as socially disruptive or destructive as the 2nd one. At least not in such acute terms as maimed children in factories and families losing their farms. At the same time, the long-term impacts of the Third Industrial Revolution have in some ways been far more transformative for society, lifestyles, and certainly for the economy.

What are the impacts so far?

Huge loss of life (WWI and WWII)

Fundamental paradigm shift in lifestyles (urbanization, office work)

Fundamental paradigm shift in economics (agrarian > industrial > service)

Are we ready for another such shift? When I look at the Fourth Industrial Revolution in strictly mathematical terms (because this is more useful) this is what I see coming:

AI—over time, AI encroaches more and more on human cognitive abilities, and will (as far as I can tell) subsume all human intellectual capabilities.

Robotics—ditto, but for physical abilities.

Quantum computing? Not even necessary to disrupt everything.

Nuclear fusion? Yeah that will be helpful to alleviate energy bottlenecks, but there are multiple ways around that (solar, fission, etc)

So, finally, I think that the Fourth Industrial Revolution represents a fundamental paradigm shift away from the constraint of human labor. For all of human history, up until now, if you wanted anything done, you needed humans in the loop. At the very least, you needed humans driving the tractors and driving the ships.

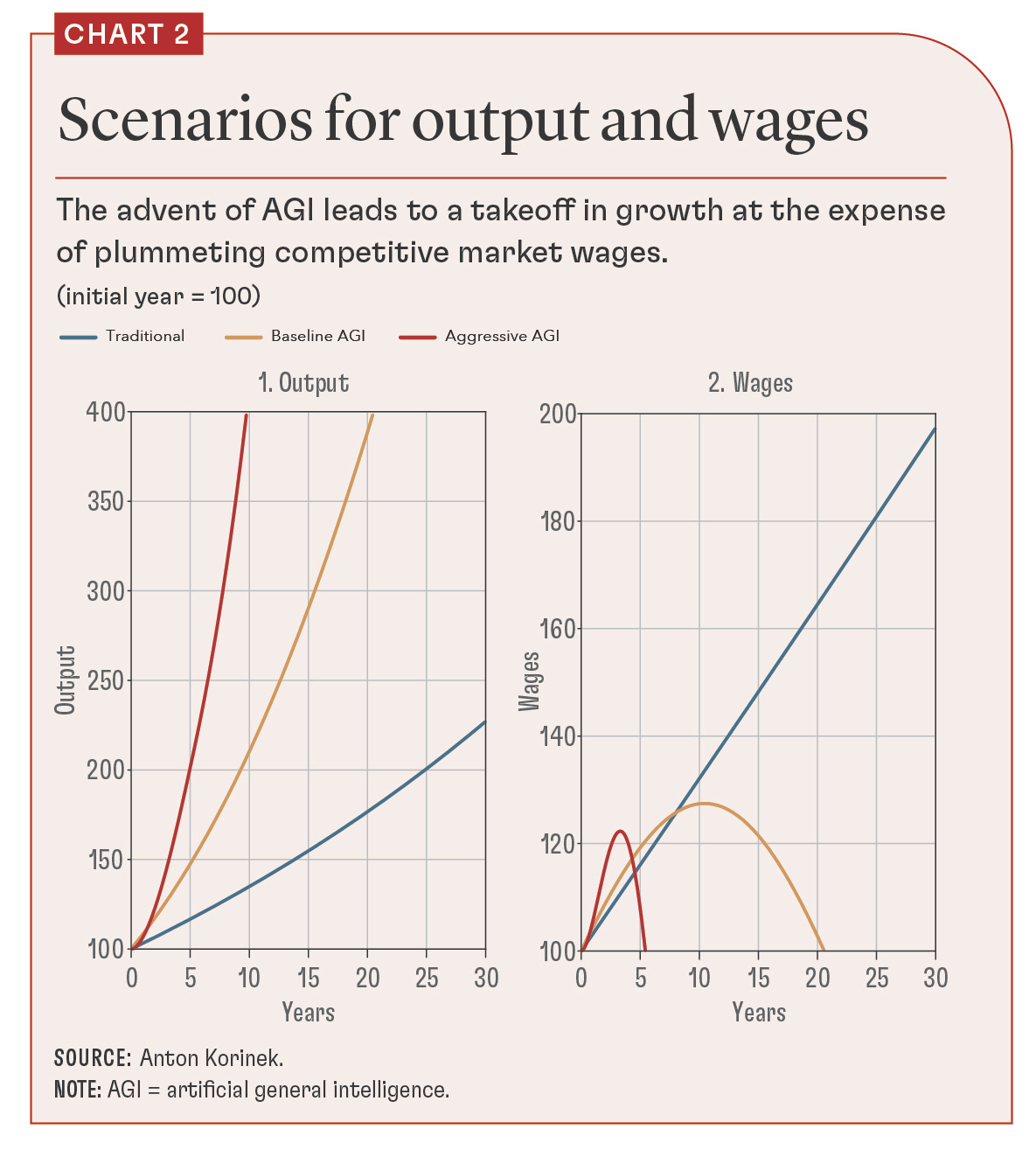

Post-labor economics describes a fundamental transformation of economic systems in which artificial intelligence and automation render human-level labor costs effectively negligible across all sectors of the economy. In this paradigm, machine capabilities exceed human capabilities by orders of magnitude in both cognitive and physical domains, creating cost differentials where automated solutions are thousands of times more cost-effective than human labor. This represents not merely an incremental improvement in productivity, but a categorical shift where human labor becomes economically irrational due to the vast efficiency gap.

This transformation represents a complete decoupling of economic growth from human labor participation. Capital fully subsumes labor as a factor of production, requiring a fundamental revision of how we measure and understand economic productivity, including metrics like GDP. The traditional wage-labor relationship that has underpinned modern economies becomes obsolete, as does the social contract built upon the exchange of labor for wages.

Post-labor economics primarily concerns itself with two key challenges: the efficient allocation of capital in a system where capital has fully absorbed the role of labor, and the economic welfare of individuals in a society where market demand for human labor has collapsed. This paradigm shift forces a reconstruction of economic models around the reality that machines can perform virtually any task orders of magnitude more efficiently than humans, creating unprecedented deflationary pressure on both cognitive and physical labor markets.

In other words, a labor-and-consumption model of economic growth might simply cease to function.

On the surface, isn’t this what we wanted all along? FALSC (Fully Automated Luxury Space Communism) is actively predicated upon the availability of TOTAL automation. That’s what AI and robotics are—the vehicles of total automation. Therefore the inevitable disintegration of the need for human labor is, by definition, a stepping stone to FALSC.

So… what comes next?

The primary concern is not “what are we going to do for work?” Exchanging labor for wages is just a means to an end, that end being economic agency.

This is a very tricky situation. Let’s outline the immediate problems in what I call “the Economic Agency Paradox”

The economic agency problem in post-labor economics represents a fundamental paradox where technological advancement simultaneously solves and creates an existential economic crisis. While artificial intelligence and automation can theoretically solve production challenges by enabling the creation of goods and services with unprecedented efficiency, this very efficiency undermines the traditional economic mechanisms that generate consumer demand. As human labor becomes economically irrelevant due to machine superiority, the wage-labor relationship that historically provided purchasing power to consumers begins to disintegrate.

This disruption reveals that the challenge lies not in production capabilities, but in maintaining meaningful economic participation and demand in a world where human labor holds negligible economic value. Traditional proposed solutions, such as universal basic income or distributed ownership of automated production systems, merely create artificial mechanisms for distributing purchasing power. These approaches, while potentially necessary as transitional measures, introduce economic friction and inefficiencies that run counter to the very productivity gains that automation promises. Moreover, they risk reducing humans to passive economic participants, dependent on state or corporate allowances rather than maintaining genuine economic agency.

The situation creates a potentially devastating feedback loop: as automation increases productivity and reduces labor costs, it simultaneously erodes consumer purchasing power, which in turn diminishes the economic value of those same productivity gains. Without a clear mechanism for maintaining consumer demand that doesn’t rely on artificial wealth distribution schemes, the entire economic system risks reaching an impasse where unprecedented productive capability coexists with collapsed consumer demand. This fundamental contradiction suggests that post-labor economics requires not just new distribution mechanisms, but an entirely new paradigm for understanding and structuring economic participation and value creation.

I personally think that we’ll hit a point where deflation is so powerful (mostly due to people losing their jobs) that something like UBI will required to prop up inflation. Or maybe we just hang on to our money because if we’re staring down the barrel of huge deflationary powers, then holding onto cash is just a smart move, an investment. If the $600,000 house that my wife and I want will be $300,000 in a few years because of deflation, well, I might as well just sit on my money and wait, right?

Ah, but therein lies the rub. If the velocity of currency drops to nil, then my money just sitting in my bank account isn’t actually creating that future, not unless I invest it.

Unless… I… invest in it?

Wait a tick. Could this be the answer?

What if the way we shore up the demand side of the economy is through maximally increasing investment opportunities with the aid of AI and decentralization? Let’s start by looking at the basic definition of economic agency under post-labor economics:

Capital Access & Control: The ability to own, control, or benefit from automated production systems. Access to the means of deploying AI and robotics. Control over or rights to the output of automated systems.

Resource Allocation Rights: The ability to make decisions about how automated resources are used. Rights to claim or direct the distribution of goods and services produced by automated systems. Access to basic necessities and luxuries in a world where human labor isn’t a prerequisite.

System Participation Mechanisms: Ways to meaningfully participate in economic decision-making without being a labor contributor. Methods to express preferences and influence production/distribution. Means to initiate new economic activities or ventures even when human labor isn’t the primary input.

So how would this “investment-centric” future work?

If you start with some money in savings, more power to you. Otherwise, we all start with UBI, and then we have a vastly expanded securities market, enabled by AI and blockchain and maybe even cryptocurrency. Consider this: you cannot invest in 99% of businesses and resources out there today. There are only about 8,000 stocks on the NYSE. That is a tiny fraction of the total businesses out there. Most businesses, assets, and productive resources are locked up in private interests. But what if we had a way to marketize and securitize literally almost everything?

This is called “tokenomics.”

Here’s where things get interesting. The investment-based future model might actually solve several aspects of the economic agency problem simultaneously. Instead of making humans passive recipients of UBI, it transforms them into active economic participants through AI-enhanced investment capabilities. But let’s break this down, because it’s not as simple as “everyone becomes an investor.” (although it kinda is that simple!)

Think about our current investment landscape. Most people can maybe buy some stocks, bonds, or mutual funds if they’re lucky enough to have savings. The really wealthy might invest in real estate or private equity. But 99% of the world’s productive assets are locked away from average people. You can’t invest in your local coffee shop unless you’re wealthy enough to buy the whole thing. You can’t own a piece of the solar array on your neighbor’s roof. You can’t benefit from the AI model that just revolutionized crop yields in your region.

But what if you could?

What if, through the magic of tokenization and blockchain technology, literally everything of value could become a liquid, tradeable asset? And what if everyone started with UBI as seed capital and had superhuman AI assistance to help them invest wisely?

This isn’t your grandfather’s stock market. We’re talking about a fundamental transformation of how value is created, shared, and traded. Imagine you wake up one morning and your AI assistant says, “Hey, that new vertical farm being built downtown? They’re offering fractional ownership tokens. Based on your interest in sustainable agriculture and local food production, this might be a good fit for your portfolio. Here’s the projected return on investment, verified through our decentralized trust networks...”

The beauty of this system is that it solves multiple problems at once. The demand-side problem? Solved, because money doesn’t sit idle—it’s constantly being deployed into productive assets, maintaining economic velocity. The participation problem? Solved, because everyone has meaningful ways to engage in the economy beyond just consuming. The distribution problem? Rather than trying to redistribute wealth after the fact, we’re creating natural pathways for everyone to build wealth through smart capital allocation.

Critics raise some interesting points about this investment-based future, but here’s the wild thing: examining these criticisms actually strengthens the case for this model. Let’s tackle them one by one.

“But what about the initial distribution problem?” they ask. “Won’t the already-wealthy just end up controlling everything?” This is where UBI comes in as the bootstrap mechanism. Everyone starts with basic purchasing power, but here’s the key difference from traditional UBI: it’s not just money for consumption, it’s seed capital for participation in the automated economy. When combined with AI investment assistance, it creates a pathway for genuine economic mobility.

“Okay, but not everyone can be a sophisticated investor.” This criticism misses something fundamental about the AI revolution. We’re not asking humans to become Warren Buffett. The AI handles the sophisticated analysis—humans just need to express their preferences and values. It’s like how you don’t need to understand internal combustion to drive a car. The AI does the heavy lifting, you just decide where you want to go. If the AI is smart enough to take your job—or all jobs for that matter—it is certainly going to be more qualified that 99% of investors out there!

“Won’t this make people passive participants in the economy?” Quite the opposite. In our current system, most people’s economic participation is pretty passive—they work at assigned tasks and consume what’s available. In an investment-based future, you’re actively directing resources toward projects and ideas you believe in. Your economic agency comes from choosing what to support and what to build, not from performing labor that machines could do better. This tickles all the Austrian brains (economic school of thought, not literal Austrians) because it allows the “social brain” of the market to allocate resources efficiently. Adam Smith’s invisible hand strikes again!

“This might work in cities, but what about rural areas?” This is where digital infrastructure and decentralization shine. Geographic limitations dissolve when capital can flow instantly anywhere. In fact, rural areas might benefit more because they can attract investment for automated infrastructure without needing local expertise. A farmer in Iowa could invest in a vertical farm in Singapore, while a tech worker in Tokyo might invest in automated agriculture in Iowa. Neoliberals eat your heart out! This is globalism on steroids!

“But won’t the market get saturated? What happens when all the good investment opportunities are taken?” This criticism accidentally reveals one of the model’s greatest strengths. When everyone has AI-enhanced investment capabilities, capital naturally flows toward genuine value creation rather than zero-sum speculation. The “hive mind” effect of millions of AI agents optimizing investments creates pressure to innovate and find new ways to create value. It's not about fighting over existing assets—it’s about continuously expanding what’s possible. Human imagination becomes the primary bottleneck. Not even software developers or scientists, because we’ll have a hyper-abundance of cognitive labor. Remember what Sam Altman said: “Intelligence too cheap to meter!”

The really interesting criticism is about systemic risk: “What if everyone’s wealth depends on these automated systems and something goes wrong?” But this is actually an argument FOR decentralization, not against our model. In a decentralized system, risk is distributed. No single point of failure can bring everything down. Plus, when everyone has a stake in the system’s success, there’s massive incentive to build in redundancies and safeguards. The 2010 “Flash Crash” is a prime example of how we’re still very much centralized. In 30 years, people will be like “You mean… you had just ONE stock exchange??? No wonder the economy was so volatile!” Decentralization allows market segmentation and compartmentalization of failure domains.

Here’s what the critics are missing: this isn’t just a tweak to capitalism or a band-aid solution. It’s a fundamental reimagining of how humans participate in economic activity. We’re moving from a world where economic agency comes from selling your labor to one where it comes from directing resources toward value creation. The AI handles the complexity, the blockchain provides trust and verification, and humans focus on what we’re best at: having preferences, making value judgments, and imagining new possibilities.

The real magic happens when you combine this with decentralized trust networks (like the ones we discussed earlier). Every investment decision becomes part of your economic identity. Your AI agents can instantly verify the track record of any project or participant. Smart contracts automatically distribute returns. The whole system becomes self-reinforcing: good ideas get funded, successful projects build trust, and value flows to those who create it.

Is it perfect? No. Will there be challenges in the transition? Absolutely. But here’s the thing: we’re already hurtling toward a post-labor economy whether we like it or not. The question isn’t whether to make this transition, but how to do it in a way that preserves and enhances human economic agency. An investment-based future, powered by AI and secured by decentralized networks, might be our best shot at creating an economy that works for everyone.

And hey, beats being fed like cattle on a state allowance, right?

TLDR: A + B = C

This basically follows the formula of A + B = C

A = Better, faster, cheaper, safer (machines nuke human jobs from orbit)

B = The economic agency paradox (deflation and jobs loss crash demand in a vicious cycle)

C = Therefore, we need a new paradigm to shore up consumer demand (investment-based economy)

Better, Faster, Cheaper, Safer: When machines become superior to humans in both cognitive and physical domains, the economic implications are inescapable. It’s not just that AI and robots will be able to perform human tasks—they’ll be able to do them orders of magnitude better, faster, cheaper, and safer than any human could. This creates an economic inevitability: any business that doesn’t transition to automated systems will be outcompeted by those that do. The cost differential will simply be too great to ignore. Imagine trying to run a transcription business with human typists when AI can do it instantly at near-zero cost, or operating a taxi service with human drivers when autonomous vehicles never get tired, never get distracted, and never need benefits. This isn’t about whether we should automate—it’s about the mathematical certainty that automation will become the only economically rational choice. Human labor, in pure economic terms, will be priced out of the market across virtually every sector.

Economic Agency Paradox: This creates a fascinating paradox at the heart of post-labor economics. On the supply side, automation promises unprecedented efficiency and productivity. Goods and services could become dramatically cheaper and more abundant as AI and robotics eliminate most production costs. However, this very efficiency creates a devastating demand-side problem: if human labor becomes economically irrelevant, where does consumer purchasing power come from? Traditional solutions like UBI might provide basic subsistence but fail to address the fundamental issue of economic agency—the ability to meaningfully participate in and shape the economy. Without a mechanism for humans to maintain genuine economic agency, we risk creating a dystopic future where hyper-efficient production systems have no one to produce for, as consumer demand collapses due to the elimination of labor income. This isn’t just an economic problem—it’s an existential challenge to how humans participate in society.

Investment-Based Future: The solution emerges when we combine the reality of machine superiority with the need for human economic agency: an investment-based future where everyone becomes a capital allocator rather than a laborer. This isn’t traditional investing—it’s a fundamental reimagining of economic participation enabled by AI and blockchain technology. Imagine a world where virtually everything of value can be tokenized and traded: local businesses, automated infrastructure, AI systems, creative works, even environmental initiatives. Everyone starts with UBI as seed capital, but instead of being passive recipients, they become active participants through AI-assisted investment. The AI handles the complexity of analysis and optimization, while humans focus on expressing preferences and values through their investment choices. This solves both the supply and demand problems: the supply side benefits from maximum automation and efficiency, while the demand side is maintained through investment returns rather than labor income. The blockchain provides the infrastructure for trust and verification, enabling truly decentralized participation. Rather than trying to preserve human jobs in an economy that no longer needs them, we create a new form of economic agency based on directing resources toward value creation. It’s not about working versus not working—it’s about transforming every citizen into a stakeholder in the automated future.

Principles for Building this Economy

Enablement Principles for Post-Labor Tokenomics

Universal Asset Tokenization must become a foundational principle of the new economy, enabling all forms of value to be represented as tradeable digital assets. This goes far beyond traditional securities to include everything from local businesses and infrastructure to creative works and environmental resources. The process must be standardized and permissionless, allowing anyone to tokenize legitimate assets while ensuring proper validation and verification. Just as neoliberalism sought to bring everything into the market, we must now enable everything valuable to be investable through tokenization. Success can be measured by tracking the percentage of total economic value that becomes accessible through tokenized investment.

AI-Enhanced Market Agency represents the next evolution in economic participation, where artificial intelligence serves as a fiduciary bridge between human preferences and complex market dynamics. Every individual must have access to AI agents that can analyze opportunities, execute trades, and manage investments on their behalf while maintaining transparent alignment with their principal’s interests. This isn’t about replacing human decision-making but augmenting it to enable participation in high-velocity automated markets. The system must guarantee that AI agents remain true fiduciaries, with success measured by tracking alignment between human preferences and AI actions.

Decentralized Market Infrastructure provides the crucial foundation that makes universal tokenization and AI agency possible and trustworthy. This requires public investment in blockchain networks, zero-knowledge proof systems, and decentralized identity solutions that enable secure, private, and efficient market operations. Just as the internet’s open protocols enabled a revolution in information exchange, we must build open protocols for value exchange. Success means creating infrastructure that’s as reliable as traditional financial systems while being more accessible, transparent, and resistant to manipulation.

Legal Framework Modernization must systematically remove friction from automated economic activity while protecting human agency. Traditional legal systems assume human actors making human-speed decisions, but a tokenized economy requires frameworks that can handle AI-speed transactions while maintaining accountability. This includes modernizing securities law, creating standards for smart contracts, and establishing clear property rights for digital assets. Success requires frameworks that enable innovation while preventing exploitation, with metrics tracking both economic activity and protection of individual rights.

Radical Market Transparency becomes not just desirable but technically enforceable in this new paradigm. Every tokenized asset must maintain real-time, machine-readable disclosure of all relevant information, enabling AI agents to make truly informed decisions on behalf of their principals. This transparency isn’t just about data availability but about making complex market dynamics comprehensible through AI interpretation. Success means eliminating information asymmetries that enable exploitation, with metrics tracking both data availability and market efficiency.

Democratic Access Guarantees ensure that the benefits of this new economic system extend to everyone, not just those who already hold wealth. Every individual must have both the right and the practical ability to participate in tokenized markets through AI-assisted investing. This includes education, technical access, and initial capital, potentially through UBI that serves as seed investment funding. Success means measuring not just market participation rates but the distribution of economic benefits across the population.

Value Capture Protection prevents the tokenization revolution from becoming another vehicle for rent-seeking and value extraction. The system must be designed to ensure that value flows primarily to those who create it or have legitimate ownership stakes, not to intermediaries or gatekeepers. This requires both technical protocols and legal frameworks that minimize extraction points and prevent artificial barriers to direct value exchange. Success means tracking the percentage of value that reaches actual creators and stakeholders versus being captured by intermediaries.

Together, these principles create the enabling conditions for a post-labor economy where everyone can meaningfully participate as an investor rather than just a laborer. They bridge the gap between traditional markets and a fully automated future while ensuring human economic agency isn’t just preserved but enhanced. The goal isn’t to replace market economics but to evolve it into a form that works for an automated age.

These principles extend, rather than replace, my Post-Labor Economics manifesto:

A Post-Labor Economics Manifesto

TLDR If you want to cut to the chase, here are the policies, heuristics, and principles I’m recommending:

I created a comprehensive overview of human history going back to the hunter-gatherer phase after reading your piece; then I prompted GPT 4o to break down each revolution and their phases of development in terms of positive and negative externalities. Quite insightful to say the least!

An excellent and profound piece, David. It’s great to see you back in your element—this is the terrain where your analysis truly shines. Your exploration of each industrial revolution feels both comprehensive and revelatory, with ideas that challenge and illuminate. The clarity and organization of your arguments make this a standout work.

While I can’t say I fully align with your solutions for the so-called “post-labor economics,” I have to admit, they hit the right nerve for sparking meaningful debate. That’s exactly the kind of provocation we need right now.

@David - I’m genuinely impressed. Your work has always been a mix of fascination and critique for me, but this article stands as your magnum opus in my view. And as for your advice on “psychedelics”… let’s just say I’m intrigued but cautious! I can’t promise a similar epiphany, but perhaps a milder, less cosmic route is worth exploring? Either way, keep up the stellar work—you’ve clearly upped the bar.