We just brainstormed 16 Post-Labor Economics market-based property interventions—and they can all be cleared, tracked, and reinvested through your bank. This excludes things like UBI or wage income. These are dividends, royalties, or equity units tied to real assets—businesses, land, data, carbon, even spectrum—and every one of them is already legal or operational somewhere today.

Each of these streams has a real-world precedent, from Alaska’s oil dividend to REI’s member rebates to employee-owned ESOP firms like Publix. What we’re proposing is to systematize and plug them into your existing banking relationship. That means you don’t need to day-trade, chase side gigs, or manage 12 apps. It all shows up in your bank account—like direct deposit for ownership.

Buying in is as easy as applying to a credit union or joining a co-op. If you qualify by geography, employment, or activity, you're in. From there, it's passive: your account grows automatically as your community, your country, and your economy grow.

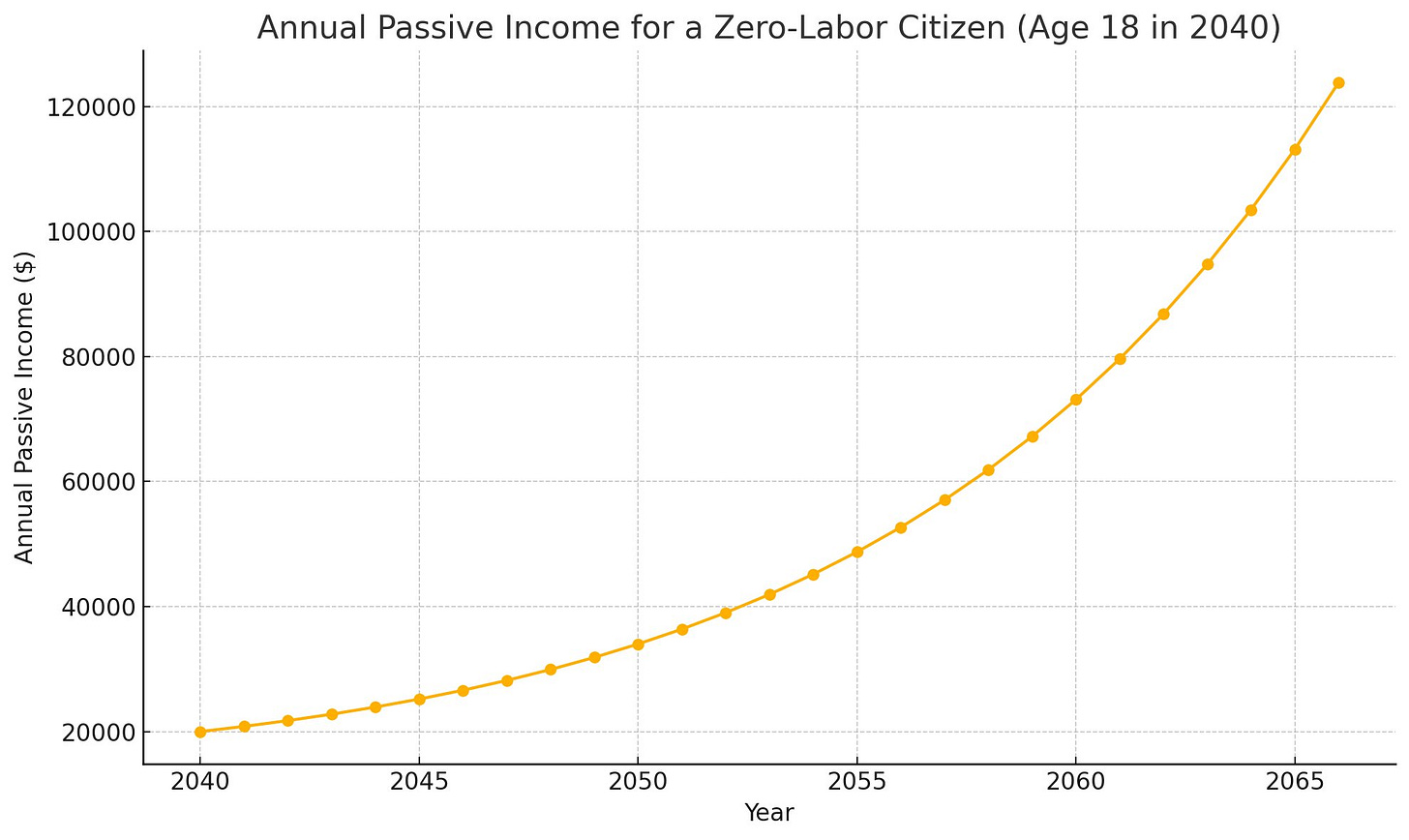

We modeled this out, and it works. If you start at age 18 with modest flows—say $1,200/month UBI plus $3,000/year in property income—your net worth climbs passively over 20–25 years to a point where you no longer need to work unless you want to. No exotic investing. No spreadsheets. Just slow compounding through default reinvestment rules mediated by the bank.

Without further ado, here are the sixteen interventions:

→ 1) Membership Foundation Dividend (Par-Share)

Every credit union member holds a small $5–$25 “par share.” When the CU earns a surplus, it distributes a foundation dividend evenly to members. These are real—Wright-Patt CU paid out $6.75M to 520k members in 2024 (~$13 per person). You don’t have to do anything except open an account and remain a member in good standing.

→ 2) Patron-Equity Kickers (“Pay-to-Own”)

Some businesses issue mini equity or revenue-share units when you shop—typically 3–5% of your purchase amount. Think of it as loyalty rewards with compounding. These units grow in value with company performance and are redeemable over time. Voluntary, opt-in, no labor required.

→ 3) Employee Stock-Ownership Plans (ESOPs)

If you work at an ESOP company, your employer contributes shares into a retirement trust. You earn ownership over time and receive dividends or a buyout when you leave. These plans exist in thousands of U.S. companies and typically return 8–12% annually in combined growth and payout.

→ 4) Multi-Stakeholder Co-op Patronage

Own a share in a co-op—whether it’s a grocery store, solar farm, or rideshare platform—and receive dividends based on your usage. If you spend $1,000/year, a 5% surplus rebate could return $50. It’s democratic ownership with real upside.

→ 5) Community Land Trust (CLT) Ground-Lease Rebates

If you live on CLT-managed land, the trust can distribute a portion of lease fees back to residents or community programs. It lowers housing costs and acts as a dividend, indexed to local land values.

→ 6) Carbon & Ecosystem Royalties

Farmers, ranchers, or forest owners can join regional trusts that sell carbon credits. The trust sends annual royalties to participants. As climate regulations and offsets mature, this could grow into hundreds per year per acre.

→ 7) Civic or Personal-Data Royalties

Cities or cooperatives can pool anonymized mobility and energy data, license it to AI platforms, and pay residents a royalty. Similar to a carbon trust, but for your digital exhaust. You just have to consent and connect your data streams.

→ 8) Compute / Spectrum Co-op Royalties

Municipalities lease fiber, 5G spectrum, or public compute space to private carriers and distribute the lease income to residents. You benefit simply by living in the area and staying connected.

→ 9) DAO or Network-State Token Units

Online communities and protocols can issue fixed-supply tokens to members. Revenue from the network buys and burns these tokens or pays a staking yield. Participation is usually voluntary or earned. Liquidity and value vary—but the upside is real.

→ 10) Qualified Ownership Dividend (QOD)

A proposed tax credit would give corporations a deduction for sending cash dividends directly to households via the banking system. You’d receive these automatically if you have an eligible account. It’s a way to turn profits into broad-based income without expanding the welfare state.

→ 11) Community-Equity Contribution (CEC) Shares

Corporations donate newly issued or buy-back stock to a public trust, and the trust allocates fractional shares to citizens. Over time, these produce dividends and appreciate. It’s a modern way to “nationalize” a small slice of every major company.

→ 12) Sector Royalty Funds

Certain sectors (data, carbon, AI, spectrum) pay a percentage of revenue into a public trust. That trust distributes dividends to every qualifying citizen. Modeled on the telecom Universal Service Fund and sovereign royalties in Norway.

→ 13) Community Endowment Funds (CEFs)

Counties or metro regions can capture land-value appreciation and local utility profits into a permanent investment fund. That fund pays annual dividends to residents. Think of it as a local version of Alaska’s oil fund, but funded by property values and usage fees.

→ 14) State Wealth Funds (SWFs)

States invest natural-resource royalties or capital gains from robot/AI taxes into a sovereign-style fund. Every resident gets a dividend. Alaska’s fund paid $1,702 in 2024. With proper design, other states could do even better.

→ 15) Dividend-Match Credit (1:3)

A federal match for your first $3 of verified property income with $1 in bonus credit—capped around $1,200/year. It’s like a Saver’s Credit for the post-labor economy. This accelerates compounding for low-income citizens.

→ 16) Dividend-Insurance (DI) Top-Up

When a dividend fund underperforms or misses a payment, a small pooled insurance mechanism backfills a portion of what you would have earned. It’s like FDIC insurance for co-ops and DAOs. Invisible until you need it.

None of this requires exotic technology. FedNow and RTP already handle instant payments. ESOPs, patronage co-ops, and public trusts already exist. The regulatory tools—tokenized deposits, qualified dividends, and reinsurance pools—are proven in other domains. What’s needed now is coordination, standardization, and pilot testing.

Over time, all of these streams compound and snowball. Each dividend or royalty isn’t just income—it’s reinvested into the same mechanisms that produced it. That means every dollar received can generate more dollars next year. Imagine someone turns 18 in the year 2040 with no job, no college, no prospects. Just a checking account at a credit union and a default setting of “reinvest everything.” They qualify for the Community Endowment dividend in their county, the State Wealth Fund in their region, a few corporate QOD payments, and some patron-equity rebates from things they already use. By age 23, they’ve stacked tens of thousands in ownership. By 33, their total passive income—UBI plus dividends—is more than enough to live comfortably, with zero labor. That’s not a fantasy. It’s arithmetic. And it’s entirely possible with the tools we already have.

We can build this. In fact, we may already have. Let’s make it visible—and then make it real.

Building the Economic Substrate for the Post-Labor Era

A deep dive for the nerds, the bankers, and the institutional realists

Let’s skip the fluff. This is a technical brief for those who already get that AI and automation are eating wage labor—and that we need systems, not slogans, to handle what comes next.

We’ve now mapped out 16 independent, modular sources of property income—dividends, royalties, and equity flows that can be distributed through your local bank. These are not dreams. They exist today in pieces. We are proposing to scale, standardize, and combine them. And crucially: to clear them through banks, because that’s the only viable “front end” the general population already uses, trusts, and knows.

Let’s be clear: universal basic income (UBI) is necessary—but it is not sufficient. Nor is a single national sovereign wealth fund. The economic transition ahead—driven by automation, AI, and the eventual decoupling of income from labor—demands a far more granular, decentralized, and pluralistic set of systems. We need markets, not just redistribution. We need private property mechanisms that accrue residual value to individuals not through charity, nor even entitlement, but through participation, presence, and shared infrastructure. Anything less would be politically fragile and economically brittle.

Why? Because no one sovereign fund, no matter how large, can adapt to the hyper-fragmented distribution of economic rents in an AI-saturated landscape. The gains will not flow evenly through government channels. They will emerge from energy royalties, protocol fees, municipal compute, data exhaust, spectrum auctions, suburban rooftops, utility corridors, and newly organized digital cooperatives. These are not well captured by traditional taxation or central distribution pipelines. What we need is a federated lattice of property conduits—autonomous, competitive, regenerative—and a mechanism to route the proceeds directly to people in a way that is legible, stable, and compoundable over time.

Enter the bank.

→ Why banks?

Because they’re already doing 80% of what this system requires. Banks and credit unions already handle KYC. They already manage cash flow, ledger integrity, dividend distribution, escrow, tax reporting, and inheritance logic. They have regulatory supervision. They have public trust. They have apps. In the twentieth century, your employer was the primary point of contact with the economy. In the twenty-first, it’s your bank. Every property stream we propose—whether it comes from a solar co-op, a data union, a public REIT, or a sovereign dividend—can land directly in a tokenized deposit account or tagged FedNow alias.

Moreover, banks already know how to scale across very different levels of intimacy. They can serve both the hyperlocal and the global simultaneously. That makes them ideal clearinghouses for both regional ownership funds and national infrastructure protocols. In practice, this turns every banked citizen into a programmable endpoint for wealth distribution—with automated reinvestment, staking rules, safety nets, and estate planning handled inside the banking interface. No new apps. No crypto wallets. No friction.

→ The regional credit union model

This is where the vision begins to root itself in physical soil. Regional credit unions are not just logical endpoints for economic flows—they are philosophically aligned. Credit unions are member-owned. They are legally obligated to serve their communities. They are structurally incapable of externalizing value. That makes them perfect stewards of things like County Endowment Funds, which can capture land value appreciation, utility royalties, or municipal lease revenue and return it to members as dividend income.

Credit unions also understand circularity. When they finance a solar array, or a cooperative grocery, or an ESOP buyout, they don’t just issue a loan—they seed a future patronage pool. That loan creates surplus, which flows back to the CU, and then back to the members in the form of lower rates or direct payments. This is not speculative finance. It is regenerative finance. And with minimal tooling, credit unions can offer programmable “ownership rails” where every member’s dividends—whether from CLTs, co-ops, or carbon trusts—are auto-swept into long-term holdings, tokenized deposits, or basic income buffers. The infrastructure is nearly there. The cultural fit is already perfect.

→ The national money-center bank

On the other end of the spectrum lie the giants: Wells Fargo, Chase, Bank of America. These firms aren’t just large—they are infrastructural. They run custodial layers for trillions in retirement and brokerage flows. They power embedded finance for fintech apps. They already operate pseudo-sovereign payment networks like Zelle and RTP. And critically, they are already piloting tokenized deposit architectures—JPMorgan’s JPM Coin moves over $2B/day internally, and that’s just the beginning.

What these banks need is not new capabilities—it’s new incentives. With shrinking fee revenues from overdrafts, declining interchange from fintech challengers, and regulatory scrutiny on rent-seeking, they are actively looking for new “stickiness” and wallet share. Distributing property income—especially through dividend-backed credit lines, robo-sweep reinvestment rules, and fractional share custody—gives them a whole new vertical. And unlike traditional deposit income, these flows compound. Every patron-equity dividend, every carbon royalty, every data share payout becomes a source of low-beta core deposits, new AUM, and digital engagement. The bank earns spread, the citizen earns ownership, and the entire system becomes more resilient.

→ Regulatory hurdles

Yes, there are hurdles. Tokenized deposits still operate in an interpretive gray zone—though OCC and FDIC guidance is trending favorably. SEC clarity on whether DAO receipts or community ownership tokens constitute “securities” is still needed. The IRS must clarify tax treatment for dividend matches and patron-equity credits, particularly in distinguishing them from traditional wages or airdrops. New legislation will be required for corporate tax incentives like QOD and CEC credits. Some statutes—such as right-of-refusal on land transfers to CLTs, or mandatory profit-sharing for spectrum leaseholders—will need to be drafted at the state level.

None of these hurdles are insurmountable. Most are clarifications or extensions of already-functioning frameworks: ESOP law, §404(k) dividend deductions, stablecoin interpretive letters, and R&D tax credits. In most cases, this is not a matter of building new law, but of wiring together the ones we already have.

→ Technical infrastructure

The technical side is perhaps even more tractable. We don’t need new rails. FedNow and RTP already handle instant micropayments. ISO 20022 already allows for structured memo tagging. Open banking APIs are mandated under Section 1033 of Dodd-Frank. Banks already publish data feeds for account aggregation. What’s needed is a standardized alias namespace for property flows (e.g. userID.ple@bank) and a taxonomy of memo tags so dividends, royalties, and equity credits can be parsed, logged, and optionally reinvested.

The front-end can be handled by existing banking apps with a few additions: a “Dividend Feed,” a “Reinvestment Slider,” a “Progress to Sovereignty” bar. That’s it. No new tokens. No speculative markets. No reinvented wheels. Just a generalized routing layer for passive income flows, using the infrastructure that already clears $5 trillion per day.

→ Failure modes and guardrails

Of course, things can go wrong. Early dividend programs could be gamed. Unsophisticated participants may cash out too early, killing their compounding curve. Dividend-backed loans may be underwritten too aggressively, triggering defaults. Protocols could rug-pull. Community land trusts could be mismanaged. Attention-economy dividends may be volatile.

But many of these failure modes are already accounted for by existing institutions. FDIC insures deposits. NCUA monitors credit-union risk ratios. Dividend insurance pools can buffer against yield volatility. CECL (Current Expected Credit Loss) modeling is already law. The ecosystem simply needs standardized thresholds—e.g., no more than 25% of any individual’s monthly budget from unbacked DAO tokens without insurance or NAV disclosure. Open-source audits and public dashboards can help ensure that community ownership vehicles are not just ideologically pure, but financially sane.

→ The closing argument

This model is not a utopian fantasy. It is a blueprint for the economic substrate of a post-labor world. It does not rely on altruism, coercion, or revolutionary change. It simply reroutes what is already happening in fragments—patronage dividends, protocol royalties, municipal lease income, carbon offsets—into a composable, bank-cleared framework that makes ownership accessible to everyone.

The result is a future where doing nothing—nothing but existing, consenting, and keeping your bank account open—builds real wealth over time. This is not welfare. It is property. It is earned by being a stakeholder in systems that were previously extractive and opaque.

The PLE model can be implemented incrementally. It works locally and globally. It gives banks a new business model, governments a resilient safety net, firms a tax-incentivized path to broader legitimacy, and citizens a path to sovereignty. Everyone wins. And we can start now—before we need to. That’s what makes it revolutionary. Not the technology. Not the theory. But the fact that it’s eminently buildable today.

This Is Braindead Simple

Let’s cut the theory and get right to the point.

Wages are going away. Maybe not for everyone, maybe not all at once—but they are steadily evaporating. AI, robots, and autonomous systems are getting better at everything. They don’t sleep. They don’t strike. They don’t get bored or distracted. And as they replace human labor, household income—the lifeblood of the consumer economy—is going to dry up unless we replace it.

Every dollar in a household budget comes from one of three sources:

Wages

Transfers

Property income

If wages disappear, and we don’t want to build a civilization dependent entirely on top-down government transfers, then the only coherent option is property. That’s it. That’s the model. There are no other sources.

The logic is not just sound—it’s obvious.

You might ask, "Why would anyone voluntarily give up their property? Why would corporations, landowners, or platforms agree to broaden ownership?" That answer is just as simple: without aggregate demand, there is no economy. If consumers are broke, they stop spending. If they stop spending, you stop earning. You can’t sell Teslas or cloud APIs to a nation of bankrupts. The system collapses under the weight of its own asymmetry.

This isn’t charity. It’s preservation. It’s enlightened self-interest.

But here’s where it gets even better.

We don’t need to build one monolithic redistribution scheme. In fact, we shouldn’t. The beauty of the Post-Labor Economics model is that it creates a buffet of property streams—patronage rebates, carbon royalties, spectrum dividends, civic data trusts, community land funds, protocol tokens, and more. These are all mediated through private-sector actors like banks, credit unions, and counties. Each stream is opt-in, legible, auditable, and modular. That means we don’t lose market feedback—we gain more of it.

Instead of a blunt wage-for-labor contract, every citizen becomes a multi-spectrum investor. They start treating co-op memberships, DAO tokens, and real estate ground leases like tools in a portfolio. They vote with their wallet, their ZIP code, and their shopping cart. They look for yield, yes—but also for impact, resilience, and alignment. The economy becomes not less capitalist—but more finely tuned.

Every spending decision becomes a signal. Every dividend a feedback loop.

And what about wealth inequality? That’s the burning question. Won’t all of this just pile more capital on top of existing capital?

Actually, no. Because this model creates a pressure release valve. When you route ownership to the base—by design, by default, by legal structure—you reduce the number of households stuck permanently in precarity. You create bottom-up compounders. That flattens the curve before you need wealth taxes. But even then, modest consumption taxes, capital gains reforms, and automated redistributive nudges (like QOD and CEC structures) are enough to keep the whole system in dynamic balance.

No guillotines required.

No central planning.

No utopias.

Just a steady, mechanical handoff:

Wages → Property.

Labor → Ownership.

Scarcity → Sovereignty.

It’s not a dream. It’s just the next model. And it’s time.

Interesting! I asked Manus to conduct a critical review of the EAI: https://zdkrnfso.manus.space/. Then I asked Manus to improve the EAI, accounting for distributional inequality:https://docs.google.com/document/d/1aBLK2wGpPDO2p3roVA_g7XgvoFjyLfEwjc56RvtWRKg/edit?usp=sharing

Holy crap, this is great. So many ideas going through my head….

One thing I wonder though. Does there need to be a certain inflection point met around things like the cost of food, housing, energy for this to really take off? Not that it has to wait, but if the cost to live goes way down (maybe healthcare goes in that bucket) does that not give this much better chance of working? I love how this article gets to practical application. Just throwing out there what I think about on this front…. Getting food production down to close to $0, etc.

I wonder if there is a role to play by folks in position to play it. If someone has the money to use and/or the ability/desire to execute (not everyone is going to want to build a solar community vertical farm), what are strategies on how to plan out the next few decades?

So many thoughts from this! Thank you!!