Economic Agency: A Key Principle in Post-Labor Economics

Economic Agency is the ability to make independent economic decisions and participate in shaping economic policies.

Economic Agency: A Key Principle in Post-Labor Economics

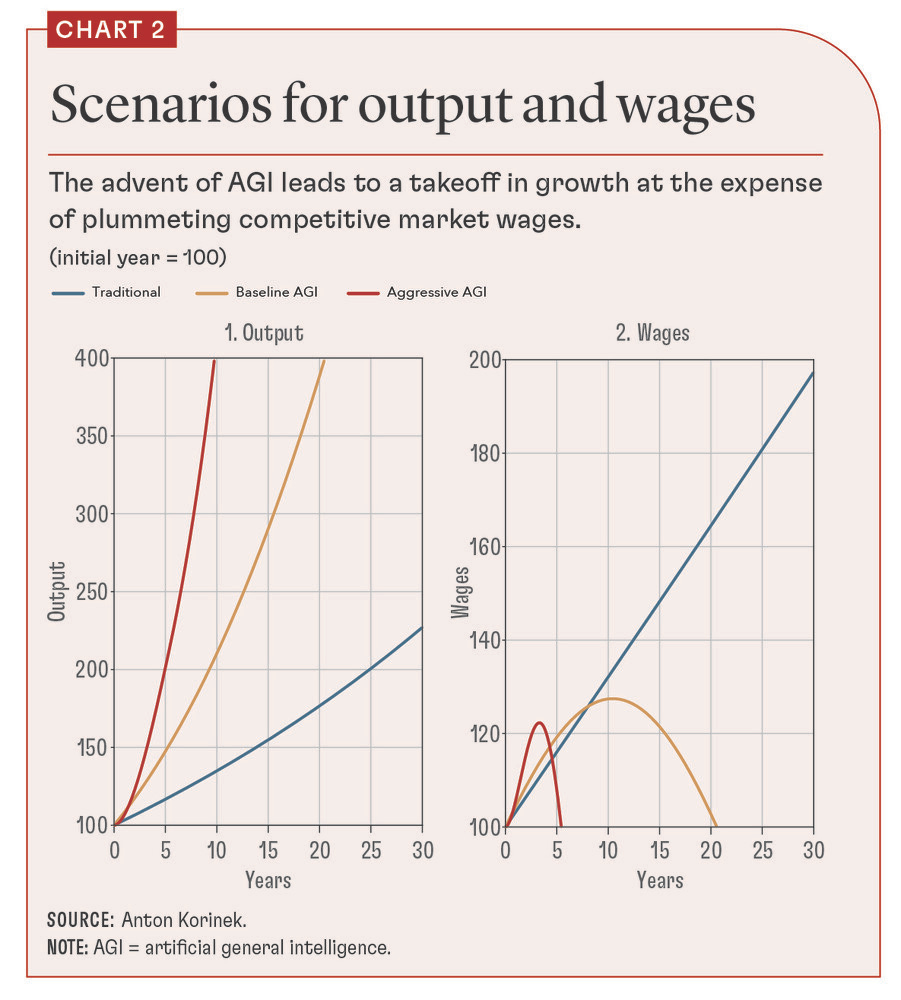

The Frontier of Automation is the line of engagement for AGI usurping jobs in a consistent and permanent basis where, essentially, material investment overwhelms labor. This is how capitalism is irreparably broken, i.e. there is no longer any distinction between capital and labor.

The above quotation came from a helpful YouTube comment on my recent video about the IMF's blog post regarding the progress of AGI and preparing for a post-AGI economy. You can see the video below.

Economic Productivity: Up and to the right

The excitement many of us feel around artificial intelligence, regardless of petty debates over "actual intelligence", is more about the production of goods and services. The basic fact of the matter is that AI will enable us to produce goods and services better, faster, cheaper, and safer. This is the fundamental nature of technology.

While all technology is dual use (CRISPR can just as easily be used to engineer a plague as cure cancer), the point I'm trying to make here is that, on the face of it, AI is the best thing that's ever going to happen to the economy. The price of some goods and services is going to absolutely collapse, such as digital entertainment. I even predict that, in the long run, hospitals and Hollywood might both go out of business. Time will tell.

A hyper-abundance of cognitive labor (e.g. the marginal cost of having a million median-intelligence agents is basically zero) or even super-intelligent machines will drastically drive down the prices of huge swaths of the economy, which will in turn have ripple and knock-on effects. Combine that with the rapidly snowballing capabilities of robots. See Two Minute Papers' latest video on the topic and really pay attention to how fluid this robot's movements are. Plumbers and welders should be put on notice.

Better, Faster, Cheaper, Safer

There are four primary criteria I look for. Once machines surpass human economic activities on these four metrics (better, faster, cheaper, safer) it becomes economically inevitable for humans to be replaced. It's that simple.

There are a handful of industries where human labor will be preferable to machine labor. These will be sentimental and experience industries, such as entertainers, caregivers, and (maybe) politicians. However, when you take a first-principles view of most jobs, which ones intrinsically require a human? The answer: very few.

The result is that we will only pay humans when our preference for humans outweighs the economic cost, which could be extremely steep. Here's an example I came up with while discussing the impact that AI will have on education. Imagine you have a robot teacher that yields better results than human teachers, and costs 1% of a human teacher's salary. Under what conditions would you pay literally 100x for the privilege of a human teacher?

While this is a hypothetical scenario, it underscores the drastic disparity that we'll be facing.

Labor Subsumed By Capital

The earlier Industrial Revolutions were characterized by a transition to knowledge work and a service based economy, but also more capital-intensive economic activity. Think factories and engines. Until the last few centuries, the most capital-intensive aspect of any industry was the land. Otherwise, almost everything was done by humans and work animals. However, with the advent of steam and internal combustion engines, all that changed. Suddenly, there was a gigantic capital component of economic productivity. Now you needed huge shipyards, factories, railways, foundries, and more. However, it was all still operated by human hands and human brains.

AI will eventually toss all that out the window. Whoever owns the means of production (AI models and the compute hardware it runs on) will be the owners of not just future capital, but also all future labor.

Lump of Labor Fallacy

When dreamy futurists think of the future and talk about Fully Automated Luxury Space Communism, they often fall into the "lump of labor" fallacy. The very short version is that there's a false belief that there's a finite amount of labor to be done, and once you do it all, everyone can live in luxury. The problem here is prices, economics, competition, and human nature. It's too much to unpack fully, but suffice to say that the more labor you can do, the more labor you demand.

I'm not saying that AI will "do all the finite amount of labor and then we can go home." No, what I'm saying is that AI's ability to do labor will so drastically outstrip human capacity to do labor that human labor will become economically irrelevant.

Let me say that again: human labor will become economically irrelevant.

Again, on the face of it, that's a good thing! Most of us hate our corporate jobs and dream of cottagecore frolicking in the countryside. Gen Z coined a phrase "I do not dream of labor." In China they call it "laying flat" or "let it rot." Young people today are checked out. And, honestly, after my last corporate job, so am I.

This all sounds lovely and utopian and wonderful, so where's the problem? Isn't a Post-Labor Economic paradigm what we've been gunning for?

The natural and inevitable flipside to Post-Labor Economics could also be called "Hyper-Capitalistic Economics." If capital is the primary thing that matters in the future, then in order to participate in the economy, by definition, you must be a capitalist.

So does that mean we seize the means of production? What do we do? Raid the data centers and pillage GPT-5 when it comes out? Good luck with that.

The Dark Side

One of the first things that people ask once they buy into the idea of Post-Labor Economics and the mantra of better, faster, cheaper, safer is "Well, then what are people going to do for a living?"

If you don't have a job (exchange labor for money) then you have no economic agency. The economy falls apart. Consumer demand plummets. The engines of the economy shut off. Everything crashes.

Right now, we fortunately have very low unemployment. However, if the Post-Labor Economy comes to fruition (which may or may not happen), we should expect to see durable and climbing unemployment. The number of permanent NEETs will be rising. This will create a vicious cycle that would inevitable result in civil war or worse.

Unemployment Rises

Fortunately, we have a very clear and simple set of metrics to watch. Rising unemployment rates and dropping total labor force participation rates. The chart immediately below is the labor force participation rate, which is lower than it ought to be, but still a long ways from danger zones.

Below is the total size of the US labor force, which is still near an all-time high.

That's the good news. So far, AI has not cratered the labor market. It might never crater the labor market. We might look back on my blog post here in 20 years and laugh. Ha! Dave, that aged like milk!

Historically, technology has created new jobs (sort of). Really, what technology does is increase productivity and reduce costs so that money and capital can be allocated elsewhere. Technology can also create new economic opportunities (the fabled "iPhone Effect"). But again, I'm not saying that the demand for labor will taper off. I'm just saying there's no reason for most jobs to go to humans if and when a machine can do it better, faster, cheaper, safer.

Consumer Demand Craters

If the labor market craters (rising unemployment, NEETs, dropping labor force participation rate), then consumer demand craters next. Low consumer demand means less spending, which means lending slows down, which means the entire economy stalls.

Part of the reason that you see the precipitous drop in the economy due to the pandemic is because people stopped spending. During times of crises, people save. They stayed home, they put off moving, buying cars, and ate out less. Now imagine we end up in a scenario with unemployment rising to 10%, then 20%, and then 30% with no sign of slowing down.

This scenario is possible within 5 years, and (in my opinion) all but guaranteed within 20 years. That is, barring some major barriers to advancing AI performance.

Economic Agency

People can find plenty to do. No one intrinsically needs a job to satisfy their psychological needs. What people do need, however, is safety, autonomy, and the ability to take care of their loved ones. This can be summed up, economically, in the concept I've dubbed economic agency.

Here's a definition of Economic Agency that I cooked up with the help of ChatGPT (the rest of this article is written 100% by hand the old fashioned way).

Economic Agency refers to the capacity and freedom of individuals and groups to actively participate and make choices within an economic system. This concept encompasses various aspects, including the ability to engage in economic decision-making, access to and control over resources, and participation in the labor market. It involves both the individual's right to work, own property, and start businesses, as well as their ability to influence broader economic policies and systems.

Central to Economic Agency is the idea that individuals should have the opportunity to contribute to, and benefit from, economic activities. This includes equitable access to markets, capital, education, and technology, and the right to engage in entrepreneurial endeavors. Economic Agency also implies participation in the governance of economic institutions and policies, reflecting the democratic principle in economic contexts.

Furthermore, Economic Agency is deeply connected to the concept of social justice, emphasizing the need for fair distribution of economic opportunities and outcomes. It acknowledges the impact of socio-economic structures on individual capacities and advocates for systems that enhance inclusivity and reduce barriers to economic participation.

In a broader sense, Economic Agency is about empowering individuals to have a meaningful stake in their economic environments, recognizing that economic health and stability are closely tied to how effectively and fairly individuals can engage with the economic system. This concept is particularly relevant in the face of evolving economic landscapes, such as the shift towards a post-labor economy driven by automation and artificial intelligence, where traditional notions of work and economic participation are being transformed.

Revolutions and Civil Wars

What do the American Revolution, American Civil War, French Revolution, Russian Revolution, People's Revolution, and Arab Spring all have in common?

The answer is simple: people were deprived of economic agency.

Humans will tolerate all kinds of governments and regimes. We've lived in kingdoms, feudal fiefdoms, empires, oppressive autocracies, fascist regimes, liberal democracies. We are flexible if nothing else. We can live in secular nations, theocracies, and everything in between.

But the one thing we will universally not abide is being deprived of economic agency.

And no, this is not just my American hubris speaking. Yes, we Americans are a bit feistier than others when it comes to economic liberty and property rights, but literally every culture in history that has experienced war, civil war, revolution, and rebellion has seen this pattern: deprive your people of economic agency and you will get violence.

Sometimes, the economic and political order is restructured peacefully. This is often done through reformers, such as Teddy Roosevelt's Square Deal. However, when the establishment uses their entrenched power structures to maintain the status quo for too long, you end up with built-up pressure.

The French Revolution happened not because the monarchy and church were fundamentally incapable of governing, but because they failed to adapt. So the French people forced adaptation through other means. Violence, as they say, is continuing politics by other means.

Forget about p(doom) and AI going Skynet and killing everyone. Depriving people of economic agency is the surest path to calamity. This is, far and away, the greatest problem facing us. To me, it's like a slow motion trainwreck that we have only a few years to avert.

Fortunately, I have some pretty solid ideas about how to avert certain doom.

Economic Agency in Post-Labor Economics

If my reading of the tea leaves is correct, and human labor is going the way of the dinosaurs, that leaves us with a purely capital-driven economy. This, in and of itself, is not a bad thing or a big deal. The question arises: how do people participate in this new economy?

Here are a few possibilities:

Centralized Redistribution (UBI, UBS, negative income tax)

If productivity goes through the roof (as we hope it will), then taxing the hyper-productive trillion-dollar Big Tech companies who will be raking in gobs of money should be no big deal. You simply skim some off the top of the economy where it's accumulating with VAT, wealth, and corporate taxes and give it to the poor. Robin Hood figured this out a few centuries ago.

Yes, I know, taxes are theft. But again, if companies don't pay "their fair share" then consumers have no money to spend the entire economy grinds to a halt. That's what I call a "lose-lose" situation.

Now, we luckily have a huge number of tools in our economic and fiscal toolbox already. There are plenty of tax schemes in place that can be leveraged to achieve this. All we need to do is dial up and down some values here and there. Tweak the corporate tax rates and rules a bit, tweak the standard deductions for individuals, maybe introduce a few new tax breaks and other incentives, and we're golden. Right?

Well, maybe not so much. We shouldn't put all our eggs in just one basket. One reason is that this doesn't necessarily guarantee economic agency.

Here's why. Imagine that you have UBI, UBS, negative income taxes, and you get checks from your city, state, and federal government every month. Sounds good, right? You just kick back and let the Big Tech companies rev up the engines of productivity and do... whatever it is you want to do. Watch anime, smoke a bong, and play Fortnite (or whatever it is that kids are playing these days, I can't keep up).

Certainly, some people are reading this and thinking "Thank God! YESSS! That's all I want!!"

But, as many people point out: when you become 100% reliant on the government, they have all the power. While this does not guarantee abuse... it certainly sets the stage for abuse, corruption, and generally setting things up to go sideways sometime in the future.

Even if you had a totally benevolent government (which let's be honest, maybe not even a benevolent AGI overlord could pull that off so long as humans are involved!) this system is entirely too lopsided. We need more than just UBI and negative taxes.

I got you covered.

Decentralized Private Ownership

Decentralized Private Ownership already exists in the form of co-ops and trusts. Since I started talking about all this Post-Labor Economics mumbo jumbo on my YouTube channel, I've had plenty of people reach out to tell me about their experience with employee-owned and profit-sharing companies.

There's also the possibility for land trusts, farm trusts, and even power company and commercial real estate trusts.

Do a thought experiment with me: What if everyone owned shares in the AGI data centers? What if everyone owned shares in their local power company?

You might be thinking: sure, plenty of people already do this. Some entities are held entirely privately, which is fine, but not everyone has the spare cash to invest in the stock market.

So what if we created new corporate structures and legal frameworks? Maybe localized stock markets? Maybe DAOs and blockchain-based companies with no employees, run by AI? I mean, think of it this way: If AI is going to be smart enough to yeet everyone out of the labor market, I'm sure it could run a farm, a forest, a solar company, and a datacenter for us.

Cities, states, and federal governments should start experimenting with new models of ownership, such as allowing DAOs and local markets. There's probably a million other ways for companies and governments to experiment with decentralized private ownership.

One of the absolute biggest things that governments can do is incentivize investment in such vehicles. My wife challenged me on this point: "If people lose their job and are subsisting on UBI, how can they afford to invest?"

Good question. I would say provide huge incentives for investment. Make it tax free. Hell, for qualified DPOs (decentralized private ownership) double their money. For every dollar you invest in a local co-op, you get two from Uncle Sam. This is just for the first year, of course.

But the idea is that you incentivize EVERYONE to buy in to this new decentralized economy. Eventually, everyone is bought in, and everyone owns the means of production. This is, obviously, over-simplified but hey, I can't think of everything.

Stakeholder Capitalism

The third and final ingredient (for now) is stakeholder capitalism. This is a bit harder to pin down, but the theory goes that if you seek to maximize the value for all stakeholders, rather than just shareholders, you'll be part of the rising tide that lifts all boats.

While the concept of stakeholder capitalism is somewhat contentious, there's mounting evidence and faith that this new paradigm is actually the way forward.

More Ways to Shore Up Economic Agency

In Western liberal democracies, we have a ton of economic agency. We can start businesses, invest freely, have a right to work, and so on. I'm still learning about economics, but the key thing that has emerged in my studies is this concept of economic agency. As best I can tell, in a post-labor world, that means participating in capital more.

One of my friends, who is a very highly paid developer for a healthcare VR company, suggested that decentralized AI (renting your computer's compute out) might be a way forward as well. Basically you could buy some solar panels and servers, stick them in your house, and rent it out. Who knows? Maybe this is a good path forward too. I don't know if that would be scalable or competitive, but it would be worth trying out.

I've got a few ideas I'm cooking up, but I don't really possess the temperament or constitution to be a big tech CEO (as much as I think I'd enjoy it) so I might just spam you here on LinkedIn with my ideas.

Your solution sounds identical to Vyrdism.

Btw, have you read "Manna" by Marshall Brain?

First part is a dystopia where human workers wear Google glasshole type headsets. The AI monitors them and can see what they see. Workers are basically puppets who do everything as told by the AI. When to do what task. How to do it. When to take a break. What to do on that break (eat, take a dump, etc.). When to come back.

If you didn't like it, you got the boot. Try to apply somewhere else that had that AI, forget about it. Bottom 10% performers got the boot every 3 months. Then every week, etc.

Basically a poor man's human robot task force ran by the AI. Very little capital investment needed and the AI learned by experience how almost all possible tasks should be done and that was fed into AI assisted design of robots that came later.

This ^^^ one can easily see mass adoption in five years and that is how long Brain depicted it happening on the book.

During all this time, robotic automation was being introduced as well, as stated.

The capitalists' solution on what to do with the permanently unemployed later on was also depicted...as well as a 'counter utopia' in response.

Only 80 pages long and I think it is free on Amazon: https://a.co/d/fLYFUKa

All very interesting. I wonder how market demand will play in this DPO world. Will the free hand of the market still play out? Meaning will consumer demand reward DPOs that provide an in-demand service and/or product and allow the under performing, out-of-demand DPOs to fail and have their resources absorbed by other DPOs? How will the ownership transfer? How will the owners of the "losing" DPO acquire funds to invest in a new DPO? Will existing DPOs even allow new investment, like a stock exchange? I actually think this could work perfectly. People will be incentivized to invest in DPOs that are "profitable" and the free hand of the market will measure the success and apply corrective action just like it does today. Basically, everyone will just have an investment portfolio. There will need to be some controls in place to prevent predatory practices, and maybe some caps, but overall this could work. Perhaps a simulation/game could be developed to prove out some of these ideas!