Nebula Protocol: How Decentralization Might Solve Everything

AI is coming and the world isn't ready for it... and why I'm so hot for Triple Entry Ledgers

AI is coming, and the world isn’t ready for it.

Soon, AI agents and robots won’t just assist us—they’ll primarily interact with each other, operating at speeds and scales far beyond human perception. As one cognitive architect observed, “Very soon, they will spend more time talking to each other than us.” This raises a critical question: how do we establish trust in such a high-velocity world? How do we ensure these AI agents are truly acting on behalf of their human principals? The answer lies not in controlling AI, but in reimagining how we establish and verify trust itself.

“Very soon, they (AI agents) will spend more time talking to each other than to us.” ~ A cognitive architect I worked with in the early days of GPT-3

The Byzantine Generals Problem

Every time you read a review on Amazon, check a Twitter verification badge, or upvote a Reddit post, you’re confronting the same challenge that computer scientists call the Byzantine Generals Problem. In its original formulation, military generals must coordinate an attack without being certain which messengers—or even which generals—might be traitors. Today, we face this dilemma every time we interact online: Is that five-star review genuine or paid? Is that viral tweet from a real person or a bot? Is that upvoted post actually popular, or manipulated by fake accounts?

What makes this problem so persistently thorny is that the internet was built on anonymity. We’ve spent decades layering on trust mechanisms—reputation scores, verification badges, identity checks—yet we still can’t answer the most basic questions about who we’re really interacting with. We can’t know for certain where users are physically located, what their true motivations are, or even whether they’re human. And if this is challenging for human-to-human interactions happening at human speeds, imagine the complexity when AI agents begin conducting billions of transactions per second globally. Our current patchwork of trust systems simply wasn’t built for that future.

Credit Cards and KYC

Our financial systems offer a perfect window into the complexity of establishing trust at scale. Take a seemingly simple credit card transaction: when you tap your card at a coffee shop, you trigger an intricate cascade of verification systems built up over decades. Your bank isn’t just checking if you have enough money—it’s analyzing whether this purchase fits your pattern. A sudden charge in another country? That triggers alerts. A purchase amount wildly different from your usual spending? More red flags.

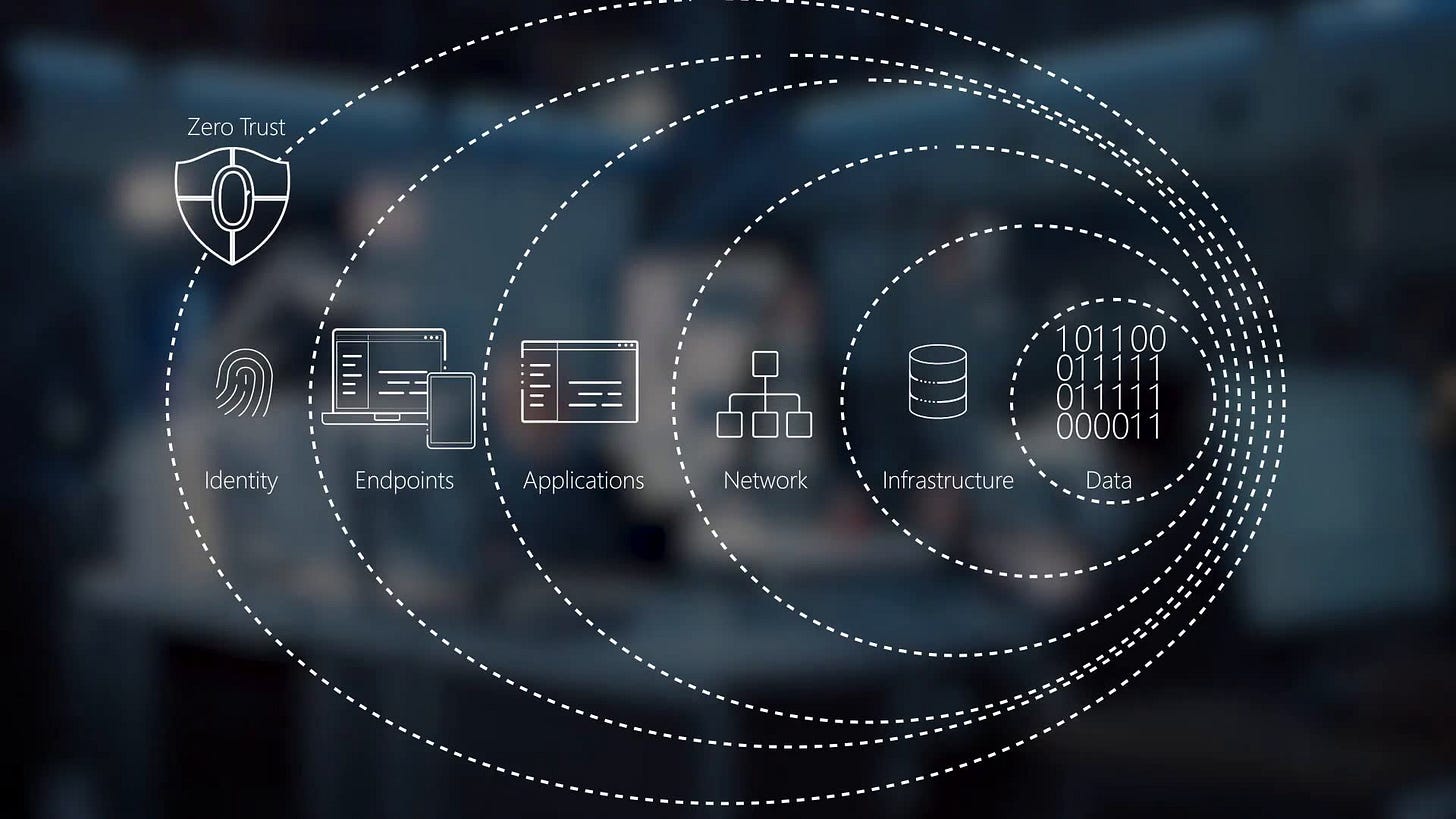

These systems represent billions of dollars of investment in what’s called “Know Your Customer” (KYC) and fraud detection, yet they’re still fundamentally reactive. Banks have built increasingly sophisticated heuristics—examining everything from your location to your typing patterns on their websites—because they operate in what security experts call a “zero trust” environment. Every transaction must be verified independently because no transaction can be inherently trusted.

And yet, despite all this infrastructure, credit card fraud still costs billions annually. Even with artificial intelligence analyzing spending patterns, geolocation data, and transaction velocities, bad actors find ways through. Now imagine scaling this challenge to a world where AI agents are conducting business autonomously, executing millions of transactions per second across global networks. Our current approach of layering more verification systems on top of fundamentally untrustworthy foundations simply won’t scale to that future.

Enter Worldcoin, a First Draft

Enter Worldcoin, Sam Altman’s ambitious attempt to solve the “infrastructure of the future” problem. The concept is deceptively elegant: combine blockchain technology, cryptocurrency, and biometric data—specifically, iris scans—to create an unassailable “proof of humanity.” Imagine a world where every YouTube comment, Reddit post, or Twitter interaction requires verification that you’re a real, unique human being. No more bot armies. No more sock puppet accounts. No more fraudulent reviews. Just genuine human interaction, verified through the immutable combination of blockchain and biometrics.

(Yes, some of my privacy fiends out there will get pretty upset over this, as they believe that anonymity on the internet is important)

It’s a compelling vision, and Altman isn’t wrong about the need. Social media platforms would be transformed if they could guarantee every interaction comes from a verified, unique human. Online fraud would plummet if every digital transaction required biometric proof. The idea of a truly global, borderless system for human verification could revolutionize everything from voting to financial services.

But here’s where Worldcoin’s vision becomes problematic: it requires specialized iris-scanning hardware—their “Orb” devices—deployed globally. More concerning is the system’s inherent centralization. Worldcoin isn’t just offering identity verification; it’s positioning itself as a new global currency, one intrinsically tied to Altman’s AI ventures. The subtext is clear: if you want to benefit from the AI revolution, you’ll need to buy into his system, use his currency, and trust his company with your biometric data.

No thanks.

While Worldcoin represents a step toward solving our looming infrastructure challenges, it ultimately repeats the same mistakes that have plagued previous attempts at digital identity: centralization, dependence on proprietary hardware, and concentration of economic power. We need to think bigger. We need a solution that’s as distributed as the internet itself, one that doesn’t require specialized hardware or consolidate control in any single entity’s hands. We need something more radical, more nuanced, and more elegant.

Global Commerce: Double Entry Bookkeeping

Imagine you’re a 16th-century merchant in Venice. You’ve just loaded a ship with valuable spices bound for England, but here’s your problem: how do you ensure your cargo actually reaches its destination without your captain deciding to sell half of it in a Spanish port along the way? This was no theoretical concern—it was the fundamental challenge of long-distance trade for millennia.

The solution, revolutionary in its elegance, was double entry bookkeeping. Each transaction would be recorded twice: once as a credit in one account, and once as a debit in another. The seller in Venice records the cargo in their ledger. The buyer in England records their expected delivery in theirs. The captain can’t simply modify one ledger because the numbers must match at both ends. When the books are eventually compared, any discrepancy immediately raises red flags.

This innovation, first systematically documented by Italian mathematician Luca Pacioli in 1494, was essentially the world’s first financial technology. Before computers, before electricity, before modern banks, this elegant system allowed merchants to conduct business across vast distances with unprecedented confidence. Double entry bookkeeping made modern commerce possible by solving a fundamental trust problem: how to verify transactions when parties are separated by time and distance.

The system was so powerful that it remains the backbone of modern accounting. Every time you check your bank balance, you’re looking at one side of a double entry system—your bank maintains the other side, and the two must always match. Every time banks transact with each other, or the government, this double entry bookkeeping plays a role. This simple yet profound innovation transformed commerce from a local, trust-based activity into a global network of verifiable transactions.

Triple Entry Ledgers: The Next Big Thing

Every time you apply for a loan, an invisible third party sits at the table: your FICO score. You didn’t create it. Your bank didn’t create it. Instead, this crucial number—which can determine whether you can buy a home or start a business—is maintained by private credit bureaus that most people never directly interact with. This is triple entry bookkeeping in its most basic form: a third party maintaining records that others rely on to establish trust.

We see this pattern everywhere in modern life. When you buy a house, you don’t just exchange money with the seller—the deed must be recorded with your county registrar. When you purchase a car, the title isn’t just between you and the dealership—it must be registered with the DMV. These aren’t just bureaucratic hassles; they’re essential third-party validations that make modern commerce possible.

This third-party validation system is quite literally the bedrock of modern civilization. When a police officer pulls you over, your driver’s license proves your identity because both you and the officer trust the government that issued it. When you swipe your credit card at a store you’ve never visited, the transaction works because both you and the merchant trust the banking network’s verification. When you sell your house to a complete stranger, both parties can proceed with confidence because the county’s property records prove you actually own what you’re selling. Without these trusted third parties maintaining authoritative records, we’d be forced to rely on personal relationships and direct trust—effectively rewinding society to a pre-industrial state where commerce could only happen between people who knew each other. The scale and complexity of modern life is only possible because we’ve built these layers of third-party validation into virtually every significant transaction and interaction.

But here’s the problem: today’s triple entry systems are fundamentally imbalanced. Credit bureaus gather vast amounts of data about your financial life, yet you have limited visibility into what they know or how they calculate your score. Government offices maintain property records, but they’re often outdated, paper-based, and vulnerable to both error and corruption. We rely on notaries and lawyers to act as trusted third parties, but this creates bottlenecks and adds substantial costs to even simple transactions.

In other words, we already live in a world that depends on triple entry ledgers—we’ve just implemented them in ways that are centralized, opaque, and often unfair. The current system favors large institutions over individuals, creates single points of failure, and builds walls between different types of records that should logically be connected. When you need to prove who you are or what you own, you often need to navigate multiple, disconnected systems of record, each maintained by different authorities with their own agendas and inefficiencies.

Tying it All Together: New Technological Options

Think about how you establish trust in your personal life. You recognize friends by their faces and voices. You remember your shared experiences. Your brain maintains an intricate web of memories and emotions that tells you exactly what you can trust each person with—maybe you trust your neighbor to water your plants but not to borrow your car, or you trust your cousin with your deepest secrets but not with financial advice. This natural system works beautifully at human scale (Dunbar’s number, or about 150 people), but it breaks down completely when we try to trust strangers or interact with thousands of people online, or in new environments where don’t know anyone.

But what if we could scale this natural trust-building process using mathematics? Imagine you and your closest friends establish your own blockchain—think of it like your group chat, but instead of living on WhatsApp’s servers, it’s cryptographically shared between all of you. Every interaction, every inside joke, every small Venmo payment for shared pizza becomes part of an immutable record that can never be deleted or altered. Just like your memories, but mathematically verified, and cryptographically stored so only you and your friends can see it.

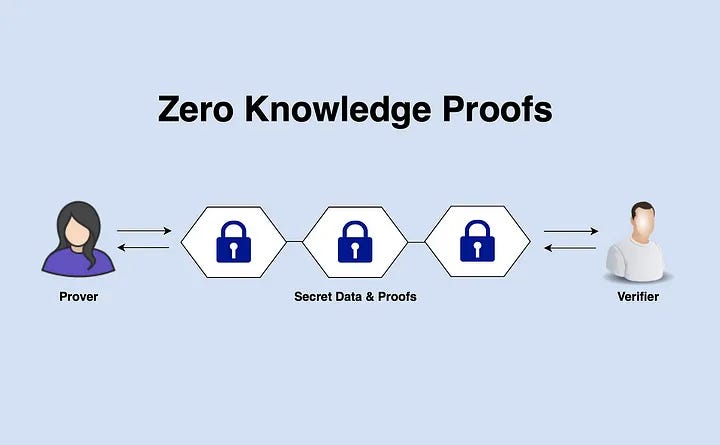

This blockchain, optimized for small groups of 7 to 12 people (coincidentally matching the size of most close friend groups), becomes your collective proof of trust. But here’s where it gets interesting: through zero-knowledge proofs and fully homomorphic encryption, this record remains completely private to your group while still being mathematically verifiable to outsiders. You could prove you regularly pay your friends back for dinner without revealing your dining habits. You could demonstrate your reliability without exposing your personal conversations. You could verify your identity without sharing your private information.

Zero-Knowledge Proofs (ZKP) allow one party to prove to another that a statement is true without revealing any additional information beyond the truth of the statement itself. Think of it like proving you’re over 21 without showing your actual birthdate, or proving you have enough money for a purchase without revealing your bank balance. Technically, this is achieved through sophisticated cryptographic protocols that can mathematically verify claims about hidden data. The implications are profound: you can verify facts, credentials, or computations while maintaining complete privacy over the underlying data, enabling everything from private digital identity systems to confidential financial transactions.

Fully Homomorphic Encryption (FHE) is a type of encryption that allows computations to be performed directly on encrypted data without needing to decrypt it first. Imagine sending a locked box to someone who can reshape and modify its contents without ever opening the box, and when you get it back and unlock it, you find the correctly processed results. While currently computationally intensive, FHE has revolutionary implications: it enables secure cloud computing where service providers can process sensitive data without ever seeing it, allows AI models to analyze private information while maintaining confidentiality, and makes it possible to create systems where privacy is mathematically guaranteed rather than just promised in terms of service.

This isn’t just a digital ledger—it’s a new way of extending human trust relationships into the digital realm. Just as you naturally trust your friend’s recommendation for a mechanic, this system lets you extend trust through verified connections. Your blockchains becomes a foundational element of your digital identity, but unlike today’s social media profiles or credit scores, you and your trusted circle control it completely.

And this is just the beginning...

Mirroring Human Trust in Blockchain Networks

Let’s look at how this works in practice through a simple social network. Alice, Bob, and Charlie have been friends since college. They share a blockchain that records their regular game nights, their shared vacation planning, and their history of splitting bills. Their phones automatically maintain this encrypted record of their friendship and trust. Similarly, across town, Indra, Kelly, and Hilary have their own blockchain documenting their book club meetings, coffee dates, and shared grocery runs. (Don’t worry, this is all automatically baked into their messaging apps and money apps, it’s all totally transparent to them)

These separate groups might never interact, except Dave, Eric, and Frank create bridges between them. Dave and Eric frequently collaborate with Alice, Bob, and Charlie at work, maintaining their own blockchain of successful projects, timely deliverables, and shared lunches. Meanwhile, Eric and Frank often play basketball with Indra, while Dave knows Kelly from volunteer work. Each of these relationships is documented in various blockchain groups—some recording financial transactions, others logging shared activities, others tracking professional collaborations. Again, it’s no different from Twitter followers, WhatsApp connections, or Venmo transactions. The difference is that your data never goes up to “the cloud” to live on a corporate server. It stays on your phones, laptops, and PCs at home, though you can certainly rent a cloud instance to store parts of your digital identity for secure backups.

This creates a rich web of trust relationships, each mathematically verified but maintaining appropriate privacy. When Alice needs to hire a graphic designer and hears about Indra’s work, she doesn’t have to trust Indra blindly. Her app can query the network: “Show me trusted connections to Indra.” The system reveals that while Alice doesn’t know Indra directly, there’s a trust path through Dave and Eric, both of whom Alice has worked with successfully. (By the way, this scales to AI systems operating autonomously or on your behalf, which is soon how much business will be conducted!)

But here’s where it gets powerful: these trust relationships are nuanced. Maybe the blockchain shows that Indra has a perfect record of delivering professional work on time, but also reveals a pattern where she’s slow to pay back personal loans. The system might show that she’s highly trusted for creative collaboration but less reliable for financial commitments. Just like in real life, trust isn’t binary—it’s contextual.

Think of these blockchains not as single global ledgers, but as intimate digital spaces shared with your closest connections. When Alice, Bob, and Charlie maintain their shared blockchain, they’re creating an immutable record of their interactions, transactions, and shared experiences. But the magic happens when these small, manageable chains interact with each other. When Bob and Charlie form another chain with Dave, they can selectively share proofs of their history without exposing private details, thanks to zero-knowledge proofs and fully homomorphic encryption. It’s like having witnesses to your life events, but witnesses who can verify your claims without actually seeing the private details. As these interconnected chains grow—Bob connecting to Dave’s network, Dave to Eve’s, and so on—each chain serves as a triple entry ledger for the others, creating a web of verified trust relationships. This is fundamentally different from monolithic blockchains like Bitcoin that require global consensus. Instead, trust emerges organically through interconnected smaller chains, each manageable and efficient, but collectively forming an unassailable network of proof. Over time, as you interact with hundreds or thousands of people and their respective chains, you build up a massive volume of mathematically provable consensus that you are who you say you are, that you own what you say you own, and that you’ve done what you say you’ve done. This eliminates the need for central authorities not through raw computational power, but through the natural accumulation of verified relationships and interactions.

Every interaction becomes part of this trust web. When you meet someone new and exchange contacts, you can choose to record that interaction publicly or privately. If you loan someone money, that transaction is logged. If they fail to pay you back, that becomes part of their reputation—not as a vindictive review, but as a mathematically verified fact within the chains you share. Future queries might reveal: “This person has a history of delayed payments in three separate trust chains.”

The beauty of this system is that it mirrors how trust actually works in human communities, but with mathematical verification. Just as you might ask mutual friends about someone’s reliability before going into business with them, this system lets you query the trust web—but with cryptographic proof rather than just hearsay. And because it’s built on small, interconnected groups rather than one central authority, no single entity controls or mediates these trust relationships.

Principals and Agents: Owning Your Piece of the AI Economy

The world Sam Altman envisions—where “capital subsumes labor”—sounds dystopian at first. In this future, traditional human labor becomes economically insignificant compared to the work done by AI agents running in vast data centers and robots operating in the physical world. But must this future concentrate all wealth in the hands of tech giants like Microsoft, Google, and Tesla? What if there was a way for everyone to own and benefit from this new economy?

Enter the principal/agent relationship. In this model, you’re not just a passive consumer of AI services—you’re a “principal,” an economic entity with verifiable trust and rights, who controls multiple “agents” working on your behalf. Some of these agents might be AI programs running on your phone, others might be cloud-based services you subscribe to, and still others might be fractional ownership in physical robots or autonomous vehicles. Think of it like having a staff of digital employees, each handling different aspects of your economic life.

But this raises a critical question: how do you ensure all these agents are actually working in your interest? How do you know you’re getting your fair share when transactions happen at AI speeds? And most importantly, how do you know that the AI agents and robots that your agents interact with are trustworthy in the first place? This is where our decentralized trust networks become transformative. Every AI agent you deploy carries your cryptographic proof of ownership. Every transaction they conduct is recorded in relevant blockchains. Every interaction becomes part of your verifiable trust network, and likewise for everyone you interact with.

Before you invest in a new robotaxi service or AI firm, your existing AI agents can instantly analyze the entire trust history of everyone involved—founders, employees, other investors. They can verify past performance, cross-reference with other trust networks, and identify potential red flags. This isn’t just reading reviews or financial statements; it’s accessing a mathematically verified history of every relevant interaction these entities have had within their trust networks. It’s the equivalent of a criminal background check, credit report, and LinkedIn investigating all in one shot, and it’s fully transparent, totally permissionless, and by the way, you don’t actually need to see their private details.

This system effectively democratizes trust verification. You don’t need the SEC to protect you from fraud when you can instantly access and verify the entire operational history of a business and everyone involved in it. Your AI agents can analyze patterns of behavior across multiple trust chains and identify potential issues before you invest. Not only that, your AIs can talk to AIs of people you trust to get help verifying someone’s identity and reputation. If someone has a history of failed projects or broken promises in any of their trust networks, that information is cryptographically verifiable.

The result is an economy where trust isn’t maintained by centralized authorities but emerges from the network itself. Your ownership of AI agents and robots isn’t just recorded in some company’s database—it’s verified across multiple trust chains that you participate in. When your agents conduct business on your behalf, their authority to represent you is mathematically provable. When they generate value, their contribution to your economic interests is immutably recorded.

DAOs, Rugpulls, and the Trust Solution

Before we explain how our trust system solves a critical problem in decentralized finance, let’s understand what a DAO is. A Decentralized Autonomous Organization (DAO) is essentially a digital-native business run by smart contracts—computer code that automatically executes when certain conditions are met. Imagine a company with no physical offices, no traditional management structure, and no government registration. Instead, it operates entirely through blockchain transactions and voting by token holders.

This sounds revolutionary until you understand the dark side: the “rugpull.” Imagine investing in a company, only to wake up one morning and find that all the assets have vanished, the founders have disappeared, and there’s no regulatory body you can appeal to for help. This is a rugpull, and it’s devastated countless investors in the Web3 space. Because DAOs exist outside traditional legal frameworks, there’s often no recourse when someone steals your money. You can’t sue a smart contract, and good luck finding the anonymous developers who created it.

This fundamental lack of accountability is why “Web3” has earned such a toxic reputation. Without any grounding in real-world trust or legal frameworks, the space has become a playground for grifters and scammers who can simply create new anonymous identities after each successful theft. It’s the digital equivalent of a con artist who moves from town to town, running the same scam under different names.

But here’s where our federated trust system changes everything: it makes anonymous scamming practically impossible. In this system, before you invest in a DAO, your AI agents can verify the entire trust history of everyone involved. Have they successfully run other projects? Do they have a network of trusted relationships? Are they connected to verified, trustworthy entities in the real world? A scammer might be able to create new crypto wallets, but they can't fake years of verified interactions across multiple trust chains.

More importantly, if someone does attempt a rugpull, it’s not just their current project that’s affected—their entire trust network sees it. Every blockchain they’ve participated in records their betrayal. Every future query about their reliability will reveal this breach of trust. It’s like having a perfect memory of every broken promise, but cryptographically verified and impossible to erase.

This creates the same social pressure that prevents most people from stealing in the real world. Sure, you might be able to shoplift once and get away with it, but eventually, the system catches up with you. In our trust network, that catching up is immediate and unavoidable. One rugpull wouldn’t just cost you your current investors—it would destroy your ability to do business with anyone connected to any trust network you’ve ever participated in.

And here’s the kicker: because these trust chains create verifiable proof of transactions and relationships, they actually give you something you can take to court. If someone steals from you, you don’t just have a missing cryptocurrency balance—you have cryptographic proof of every interaction, every promise, and every breach of trust. This creates a bridge between the decentralized digital world and traditional legal systems, allowing you to seek real-world remedies for digital crimes.

The Three Pillars of Trust

Before we peek into a future built on these technologies, let’s understand the three fundamental innovations that make it possible.

Triple entry ledgers on blockchain represent an evolution of how we record and verify truth. While traditional double entry bookkeeping allowed two parties to maintain matching records, triple entry adds an immutable, cryptographically secured third record that anyone can verify. This solves the fundamental problem of trust at scale—instead of relying on central authorities to maintain official records, we can create mathematically verified proof of any transaction or interaction that’s distributed across multiple participants.

Zero-knowledge proofs (ZKP) solve a different but equally crucial problem: how to prove something is true without revealing any underlying information. Imagine being able to prove you have enough money for a purchase without showing your bank balance, or proving you’re over 21 without revealing your birth date (or that you are trustworthy without sharing your entire private history!). ZKP makes this mathematically possible, allowing us to verify claims without exposing private data. This technology bridges the gap between privacy and trust, letting us build systems that can verify without violating confidentiality. So, if you ask someone “Is Dave being honest here?” someone you trust says “Why yes he is!” without every revealing what’s actually in their brain.

The final piece is fully homomorphic encryption (FHE), which allows computations to be performed on encrypted data without decrypting it first. Think of it as a locked box that you can reshape and modify without ever opening. This means AI agents can analyze patterns, make decisions, and process information while keeping the underlying data completely encrypted. When combined with blockchain and ZKP, FHE allows us to create systems that can learn from and react to private information without ever exposing it. Again, this is not unlike how humans work—you can never see what’s in my brain, but I can tell you what’s in it, and I can also keep it private if needed.

Together, these three technologies solve what seemed like an impossible paradox: how to create systems that are simultaneously transparent enough to trust and private enough to use for sensitive information. They allow us to build networks that can verify truth while protecting privacy, process information while maintaining security, and establish trust while preserving autonomy.

A Day in the Life: 2035

Alice wakes to gentle chimes from her Nebula client—not an alarm exactly, but a subtle suggestion that she might want to start her day. She doesn’t need to check if she slept well; her health metrics are automatically logged to her private blockchains, accessible only to her and her chosen medical AI agents. “Good morning,” she mumbles, and her personal AI acknowledges with a quick rundown of her vitals and a weather report.

The Nebula interface glows softly on her bedroom wall—a projection from her phone, but her personal client maintains connections to dozens of blockchain networks, each one a strand in her web of trust relationships. Like most popular software now, Nebula wasn’t built by a corporation but emerged from a collaborative network of AI agents and human developers, its entire codebase living on public blockchains where anyone can verify every line of code. There’s no company behind it, no profit motive, just an open-source tool that helps people manage their distributed digital lives. Alice’s personal instance of Nebula keeps perfect copies of her most important chains locally, with encrypted shards distributed across her devices, trusted cloud services, and even fragments cached on her friends’ systems for redundancy. Her client is hers alone—uniquely configured, deeply personal—but it speaks the same protocols as everyone else’s, maintaining her place in the vast web of interconnected trust chains that now undergird digital society.

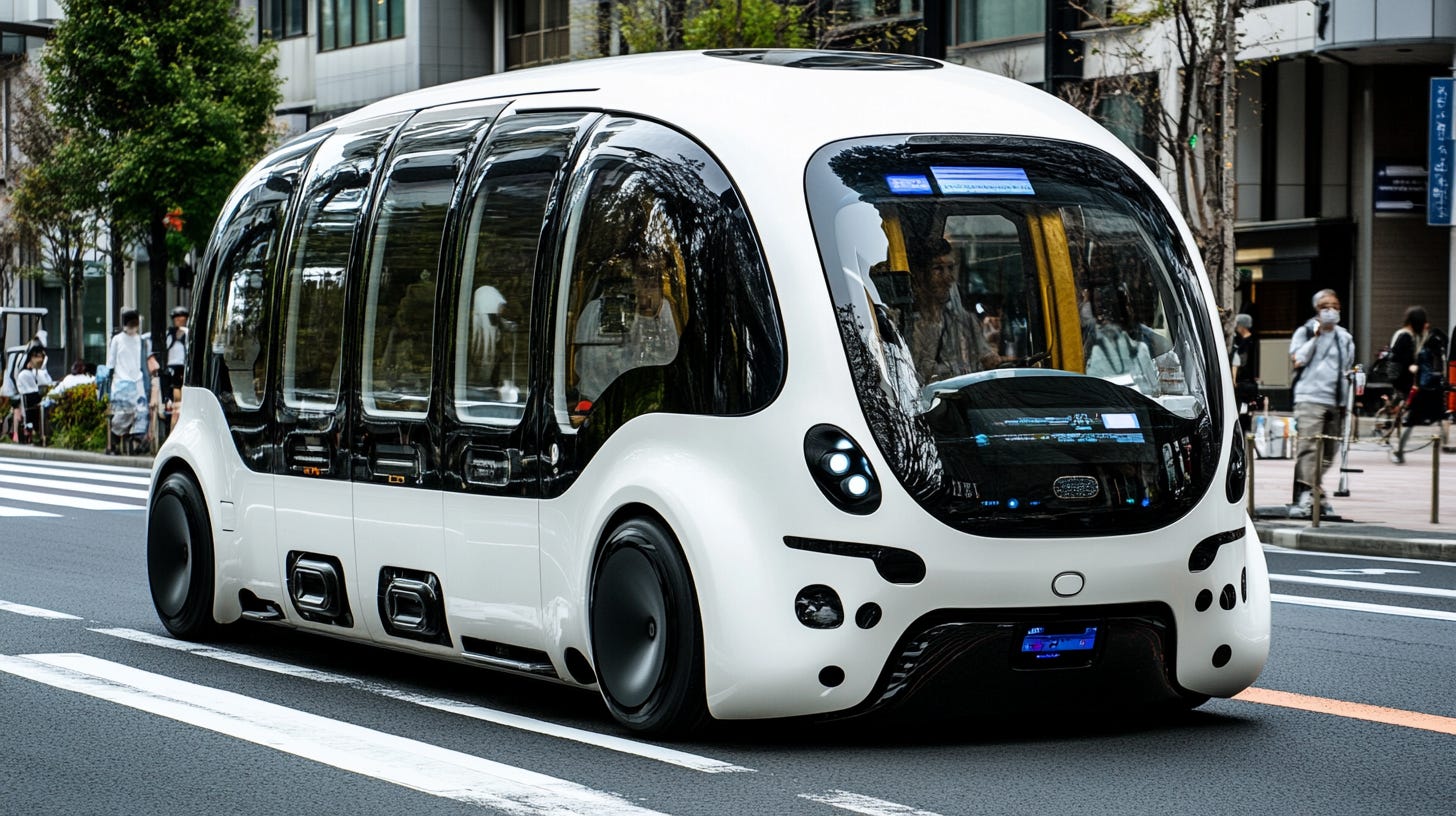

“Your usual Thursday robotaxi will arrive in twenty minutes,” her AI mentions casually. Alice smiles—she hasn’t explicitly scheduled these rides in months, but Nebula has learned her patterns. As she gets ready, she scrolls through her friend feed, not on some corporate social media platform but directly through her trust networks. She sees Bob’s latest art project (tokenized and already attracting fractional investors), a debate Charlie’s having about local energy policy, and private photos from Diana’s vacation that are only visible to their shared trust circle.

Her wrist buzzes with a notification about her data center investment. “Investment Update: Trinity Computing Node 7 has completed its quantum cluster integration. Expected revenue increase of 13.2% based on current compute demand.” Alice grins—she’d bought into this project six months ago after Nebula had highlighted the development team’s impressive track record. Their reputation chains showed successful builds across three different counties, with every project delivering on time and exceeding revenue projections.

What’s remarkable isn’t just the investment’s success, but how seamlessly every aspect of the project had been executed through the trust networks. The developers had acquired the land through direct peer-to-peer transactions with the previous owners, their AIs negotiating terms in microseconds. Construction robots were hired from a decentralized hardware pool, their work verified and logged in real-time to the project’s blockchain. Even the quantum processors came from the local chip foundry—gone are the days of relying on distant manufacturing giants. Every component, from the cooling systems to the quantum chips, was sourced through reputation-verified suppliers on the network.

A soft chime indicates her robotaxi’s arrival. As she steps in, she notices it’s one she partially owns—like most people, she has fractional ownership in various autonomous vehicles operating in her area. The taxi’s internal display shows her micro-earnings from its recent trips, automatically distributed across her various wallets. No need for a central ride-sharing company taking a cut; the entire transportation network is just a web of smart contracts between vehicle owners, maintenance providers, and passengers. The cars even maintain themselves, self-monitoring with advanced AI to listen in on their own components, and driving themselves to the shop when needed!

During the ride, she dips into the town’s governance feed. The interface shows a proposal from a real estate developer called Green Valley Properties about converting the old park area into new housing. In the past, this would have meant months of city council meetings, activist protests, and behind-the-scenes dealings. Now, it’s a transparent process happening in real-time. AI agents representing various community interests are already analyzing the proposal’s impact on everything from local wildlife to property values.

Alice watches as the town’s collective intelligence emerges. Her own AI agent, knowing her preferences from years of interaction, has already registered her concern about maintaining green spaces. It’s fascinating to watch the consensus visualization: hundreds of AI agents, each representing different residents and stakeholders, negotiating in milliseconds. Some agents represent elderly residents concerned about medical facility access, others speak for young families wanting affordable housing, while environmental advocates’ AIs cite detailed impact studies.

The developer’s reputation is on full display—their previous projects, their history of community engagement, their pattern of following through on promises. Through the trust networks, everyone can see they’ve successfully built in other towns, but they also sometimes cut corners on environmental commitments. This isn’t hearsay or news articles; it’s cryptographically verified history from multiple blockchain sources.

Within hours, a new consensus emerges. The community’s AI agents have collectively shaped a counter-proposal: yes to development, but with a smaller footprint, integrated green spaces, and a small data center that would generate revenue for the town. The developer’s AI immediately begins adjusting plans based on this feedback. Alice marvels at how different this is from the old days of contentious town halls and private deals—now everything happens in the open, with AI agents ensuring every stakeholder’s interests are considered and verified.

At lunch with friends, Alice uses her Nebula client to split the bill automatically. The transaction is seamless, but behind the scenes, it’s being recorded across multiple trust chains—contributing to everyone’s financial reputation, updating their spending patterns for their AI agents to factor into future decisions, all while maintaining perfect privacy through zero-knowledge proofs. Nobody outside their trust circle can see the transaction details, but anyone can verify that it happened and was agreed upon by all parties.

Their conversation turns to the new quantum computing center they’ve all invested in. Bob pulls up a completely transparent view of the facility’s operations—every compute cycle sold, every watt of power consumed, every maintenance robot deployed. There’s no need for quarterly earnings reports or shareholder meetings; everything is visible in real-time to stakeholders, while remaining private from competitors thanks to homomorphic encryption.

As evening approaches, Alice decides to take a different robotaxi home—this one operated by a cooperative she doesn’t have shares in. It doesn’t matter; her Nebula client seamlessly interfaces with their system because all transport networks use the same trust protocols. The payment is automatic, the reputation systems are interoperable, and her comfort preferences are securely shared without exposing her private data. That is the power of the Nebula Protocols.

At home, she settles in for her evening review with her AI. “Show me today’s summary,” she says, and Nebula displays a holographic overview of her various wallets and investments. Unlike the old days of checking different apps and accounts, everything is in one place—yet completely distributed across hundreds of blockchains. Her AI walks her through the highlights: micro-earnings from her robotaxi shares, computing revenue from three different data centers, even small royalties from some AI models she helped train last year.

“Your trust networks grew by three degrees today,” the AI notes. “Remember that quantum engineer you met at lunch? They’re now connected through Bob’s professional chain, and their reputation scores in quantum architecture are exceptional. Would you like me to watch for investment opportunities in their future projects?”

Alice also notices that her town’s treasury has grown—the local chip foundry is now producing quantum-ready processors that other communities are buying. Like many small towns now, hers has become largely self-sufficient through distributed ownership of productive assets. They haven’t needed to collect traditional taxes in years; the town’s services are funded entirely through shared ownership of automated infrastructure.

And, by the way, Alice hasn’t voted in a local election in years, either. The last conventional vote was a ballot measure to abolish all human officers from the town, and switch everything over to this decentralized Nebula system. Why use human politicians when they are dumb, slow, and can be bribed?

Before bed, she authorizes her AI to continue making decisions within her pre-set parameters while she sleeps. Unlike the old days of markets closing at night, the AI economy runs 24/7, and her agents never stop working for her interests. They’ll monitor her investments, adjust her utility usage based on real-time energy prices, and even participate in community decisions if anything urgent comes up overnight.

“Oh, and your sister’s getting married next month,” her AI reminds her. “Based on their registry and your shared trust history, I’ve identified three gifts that match their preferences and your usual spending patterns for family events. Would you like to review them now or in the morning?”

As Alice drifts off to sleep, her Nebula client continues its work—coordinating with millions of other agents, maintaining her trust relationships, protecting her interests, all through cryptographically secure, completely transparent, yet fully private networks. Her phone screen dims, but the client remains active, distributed across the town’s data centers, part of the invisible fabric that has replaced the old world of central authorities, corporate intermediaries, and human bureaucracies.

In the darkness, countless AIs continue their dance of consensus and verification, each interaction recorded immutably yet privately, each transaction building and reinforcing the web of trust that now underlies every aspect of human society. The revolution wasn’t in replacing humans with AI, but in creating a system where humans could safely delegate their interests to AI agents while maintaining complete control and transparency. The age of centralized trust is over; the era of distributed, verified truth has begun.

Closing Thoughts: From Science Fiction to Science Fact

While Alice’s story might seem like distant science fiction, the technological building blocks for this decentralized future already exist. Let’s examine the key technologies that are paving the way:

Worldcoin: Sam Altman’s ambitious project represents the first large-scale attempt to create a decentralized “proof of personhood” system. By combining biometric verification, blockchain technology, and cryptocurrency, Worldcoin demonstrates how we might establish unique digital identities without central authorities. While its reliance on specialized hardware and centralized infrastructure shows its limitations, Worldcoin proves that global-scale decentralized identity systems are technically feasible. It’s setting critical precedents in privacy-preserving biometric verification and blockchain-based identity management, even if it’s not the complete solution we ultimately need.

IPFS (InterPlanetary File System): IPFS has already revolutionized how we think about data storage and retrieval. By replacing location-based addressing with content-based addressing, IPFS demonstrates how decentralized storage can work at global scale. The protocol is already being used by major organizations for everything from scientific data distribution to website hosting. Its success in handling large-scale distributed data proves that we don’t need centralized servers to manage global information systems. IPFS’s content-addressed storage model is exactly what we need for the kind of distributed trust networks described in Alice’s story.

Ethereum Name Service (ENS): ENS shows how basic internet infrastructure can be decentralized effectively. By providing a distributed alternative to traditional DNS, ENS proves that even fundamental internet services don’t require central authorities. Its adoption by major wallets and platforms demonstrates how decentralized services can achieve mainstream usability. The success of ENS in creating human-readable names for blockchain addresses provides a crucial blueprint for how other core internet services could be decentralized.

Radicle: As a decentralized alternative to GitHub, Radicle is pioneering how collaborative software development can work without central platforms. This becomes critically important as we enter an era where AI is generating more code than humans. Radicle’s peer-to-peer approach to code hosting and collaboration will be essential when AI agents are continuously developing and improving software across distributed networks. Its focus on cryptographic verification and distributed governance provides a model for how AI-generated code can be safely managed and deployed.

Advanced AI: The exponential advancement in AI capabilities, particularly in language models and multimodal systems, is the keystone technology that will make widespread decentralization practical. These systems are already capable of generating sophisticated code, understanding complex protocols, and managing distributed systems. As AI continues to evolve, it will automatically handle the complexity of decentralized systems, making them as easy to use as traditional centralized services. AI will serve as the bridge between human intentions and complex distributed protocols, making blockchain and other decentralized technologies accessible to everyone.

Robotics: The rapid evolution of robotics, from Tesla’s Optimus to Boston Dynamics’ Atlas and Unitree’s G1, demonstrates that physical automation is catching up to digital automation. These robots represent the physical infrastructure that will need to integrate with our decentralized digital systems. As robots become more sophisticated and widespread, they’ll need reliable, decentralized systems for identity, trust, and coordination. The emergence of capable humanoid robots makes the need for decentralized trust systems even more urgent, as these physical agents will need verifiable ways to prove their identity and authorization.

What’s remarkable isn’t just that these technologies exist, but that they’re already mature enough for practical use. The challenge isn’t inventing new technology—it’s integrating existing technologies in ways that preserve human agency and promote economic equality. We have all the pieces needed to build Alice’s world. The question isn’t whether this future will arrive, but whether we’ll shape it thoughtfully and ethically to benefit everyone, not just those who control the current digital infrastructure.

The time to start building this future is now, while these technologies are still malleable and before current power structures become further entrenched. The tools exist. The knowledge exists. All that’s needed is the will to put them together in service of a more equitable, decentralized future.